Sharp ER-A420 ER-A410 ER-A420 Operation Manual - Page 80

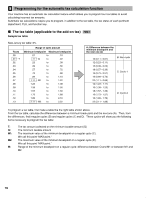

The tax table applicable to the add-on tax

|

View all Sharp ER-A420 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 80 highlights

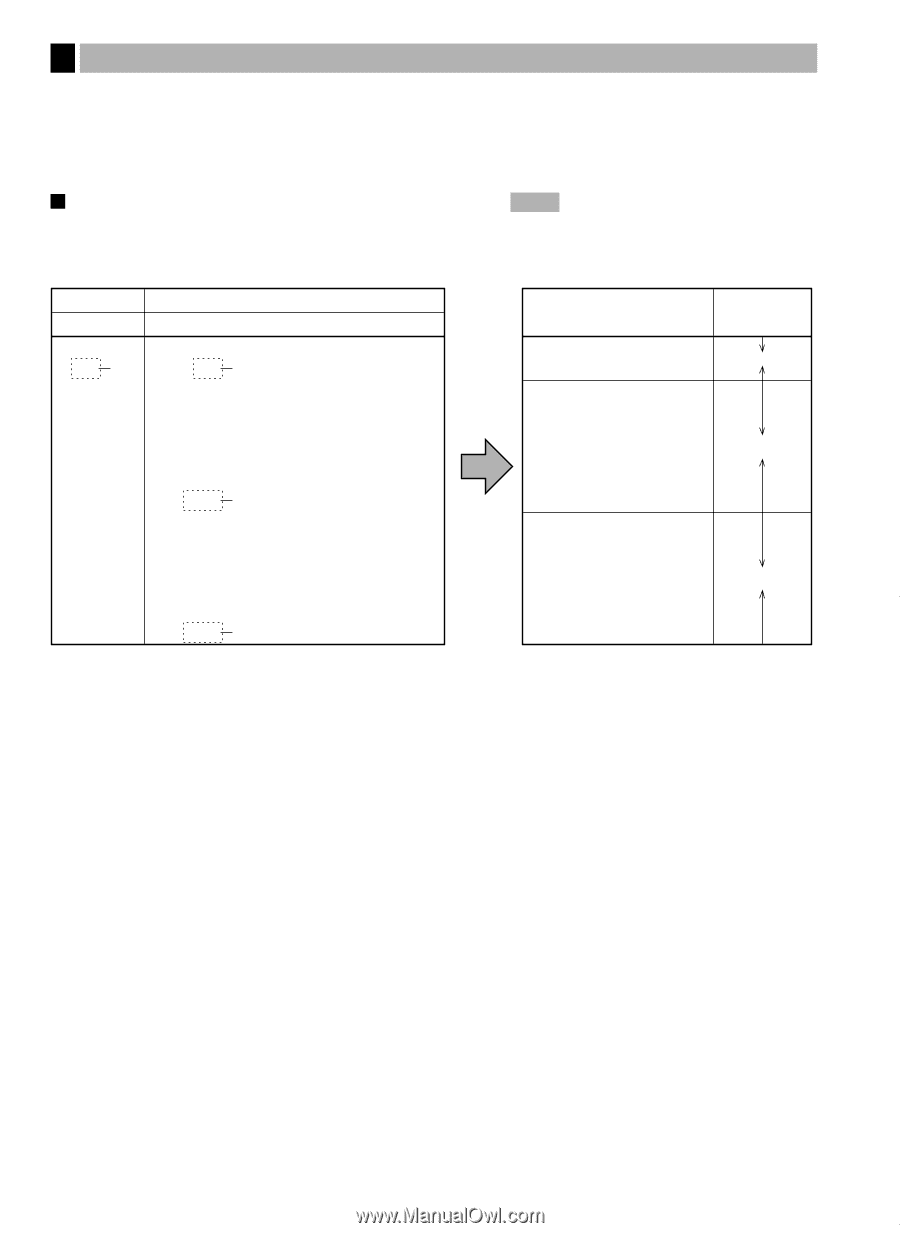

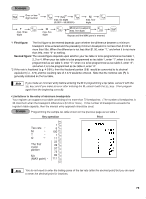

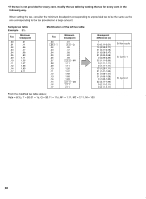

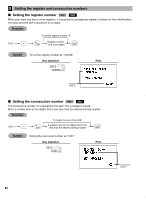

9 Programming for the automatic tax calculation function Your machine has an automatic tax calculation feature which allows you to program four tax tables to avoid calculating incorrect tax amounts. Automatic tax calculations require you to program, in addition to the tax table, the tax status of each pertinent department, PLU, and function key. The tax table (applicable to the add-on tax) PGM 2 Sample tax table New Jersey tax table: 6% Taxes .00 .01 T .02 .03 .04 .05 .06 .07 .08 .09 .10 .11 .12 .13 Range of sales amount Minimum breakpoint Maximum breakpoint .01 to .10 .11 Q to .22 .23 to .38 .39 to .56 .57 to .72 .73 to .88 .89 to 1.10 1.11 M1 to 1.22 1.23 to 1.38 1.39 to 1.56 1.57 to 1.72 1.73 to 1.88 1.89 to 2.10 2.11 M2 to 2.22 A: Difference between the minimum breakpoint and the next one (¢) - 10 (0.11 - 0.01) 12 (0.23 - 0.11) 16 (0.39 - 0.23) 18 (0.57 - 0.39) 16 (0.73 - 0.57) 16 (0.89 - 0.73) 22 (1.11 - 0.89) 12 (1.23 - 1.11) 16 (1.39 - 1.23) 18 (1.57 - 1.39) 16 (1.73 - 1.57) 16 (1.89 - 1.73) 22 (2.11 - 1.89) B: Non-cyclic C: Cyclic-1 D: Cyclic-2 To program a tax table, first make a table like the right table shown above. From the tax table, calculate the differences between a minimum break point and the next one (A). Then, from the differences, find irregular cycles (B) and regular cycles (C and D). These cycles will show you the following items necessary to program the tax table: T: The tax amount collected on the minimum taxable amount (Q) Q: The minimum taxable amount M1: The maximum value of the minimum breakpoint on a regular cycle (C). We call this point "MAX point." M2: The maximum value of the minimum breakpoint on a regular cycle (D). We call this point "MAX point." M: Range of the minimum breakpoint on a regular cycle: difference between Q and M1 or between M1 and M2 78