Sharp ER-A420 ER-A410 ER-A420 Operation Manual - Page 82

If the tax is not provided for every cent, modify the tax table by setting the tax for every cent

|

View all Sharp ER-A420 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 82 highlights

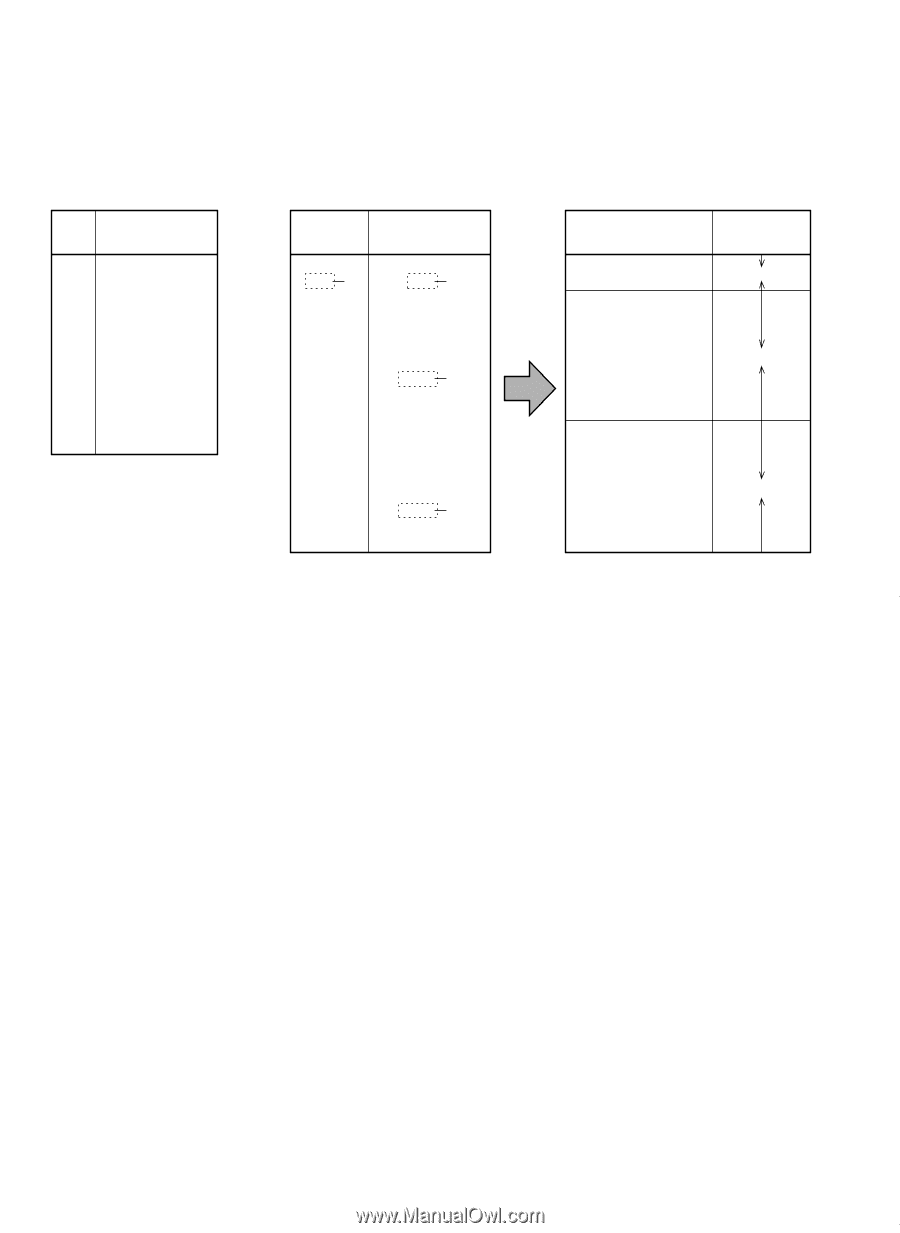

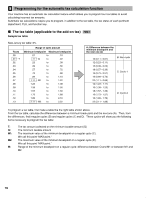

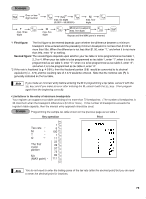

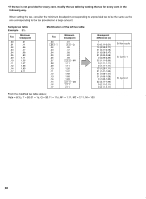

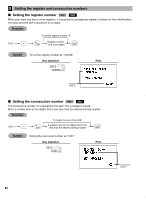

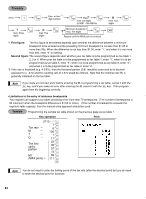

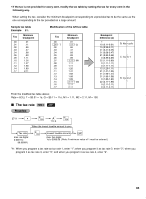

• If the tax is not provided for every cent, modify the tax table by setting the tax for every cent in the following way. When setting the tax, consider the minimum breakpoint corresponding to unprovided tax to be the same as the one corresponding to the tax provided on a large amount. Sample tax table Example 8% Minimum Tax breakpoint .00 .01 .01 .11 .02 .26 .03 .47 .04 .68 .06 .89 .09 1.11 .10 1.26 .11 1.47 .12 1.68 .14 1.89 .17 2.11 Modification of the left tax table Tax .00 .01 T .02 .03 .04 .05 .06 .07 .08 .09 .10 .11 .12 .13 .14 .15 .16 .17 Minimum breakpoint .01 .11 Q .26 .47 .68 .89 .89 1.11 M1 1.11 1.11 1.26 1.47 1.68 1.89 1.89 2.11 M2 2.11 2.11 Breakpoint difference (¢) 1 10 (0.11-0.01) 15 (0.26-0.11) 21 (0.47-0.26) 21 (0.68-0.47) 21 (0.89-0.68) 0 (0.89-0.89) 22 (1.11-0.89) 0 (1.11-1.11) 0 (1.11-1.11) 15 (1.26-1.11) 21 (1.47-1.26) 21 (1.68-1.47) 21 (1.89-1.68) 0 (1.89-1.89) 22 (2.11-1.89) 0 (2.11-2.11) 0 (2.11-2.11) B: Non-cyclic C: Cyclic-1 D: Cyclic-2 From the modified tax table above; Rate = 8(%), T = $0.01 = 1¢, Q = $0.11 = 11¢, M1 = 1.11, M2 = 2.11, M = 100 80