Sharp XE-A406 XE-A406 Operation Manual in English and Spanish - Page 23

Cash or check tendering, Finalization of Transaction, Displaying Subtotals

|

UPC - 074000049536

View all Sharp XE-A406 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 23 highlights

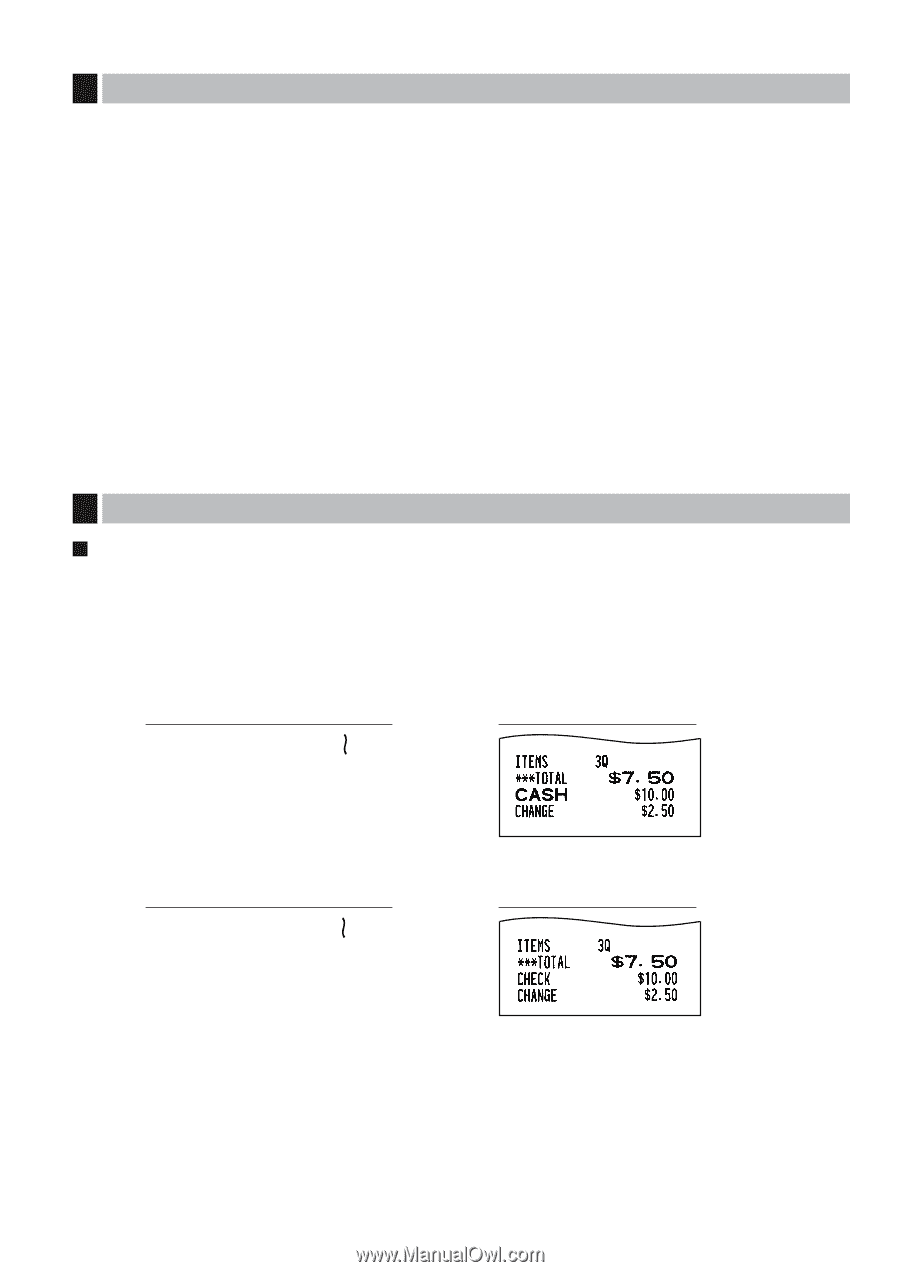

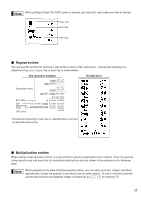

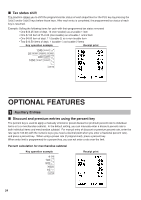

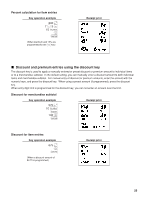

4 Displaying Subtotals The register provides three types of subtotals: Merchandise subtotal m Press the key at any point during a transaction. The net sale subtotal - not including tax - will appear in the display with the function message "MDSE ST". Taxable subtotal Taxable 1 subtotal T s Press the and keys in this order at any point during a transaction. The sale subtotal of taxable 1 items will appear in the display with the function message "TAX1 ST". Taxable 2 subtotal U s Press the and keys in this order at any point during a transaction. The sale subtotal of taxable 2 items will appear in the display with the function message "TAX2 ST". Including-tax subtotal (complete subtotal) s Press the key at any point during a transaction. The sale subtotal including tax will appear in the display with the function message "SUBTOTAL". 5 Finalization of Transaction Cash or check tendering s Press the key to get a complete tax subtotal, enter the amount tendered by your customer, then press the A C key if it is a cash tender or press the key if it is a check tender. When the amount tendered is greater than the amount of the sale, the register will show the change due amount with the function message "CHANGE". Otherwise the register will show a deficit with the function message "DUE". You now must make a correct tender entry. Cash tendering Key operation example Receipt print s 1000 A Check tendering Key operation example s 1000 C Receipt print 21