Sharp XE-A407 XE-A407 XE-A43S Operation Manual in English - Page 90

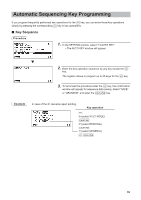

Doughnut exempt

|

View all Sharp XE-A407 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 90 highlights

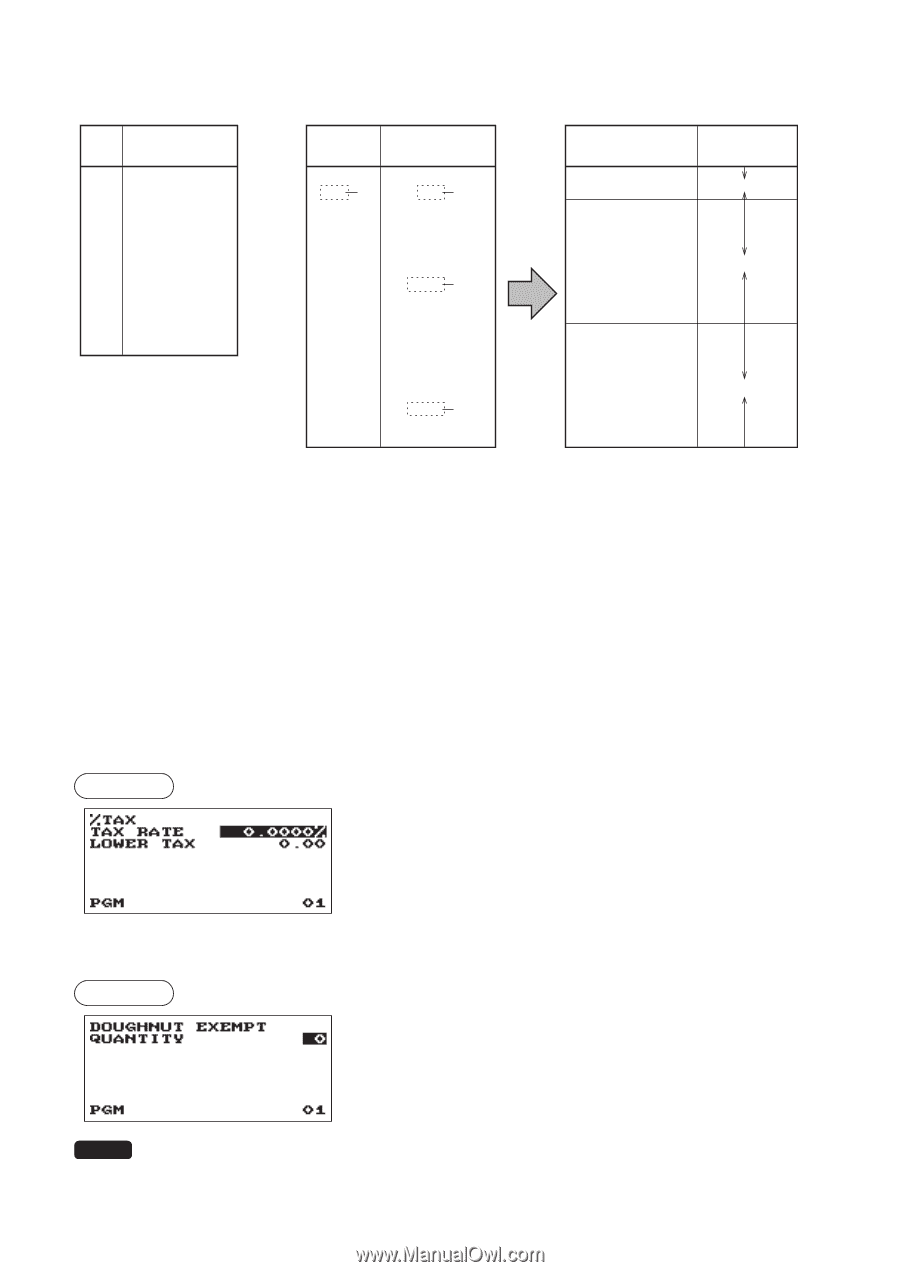

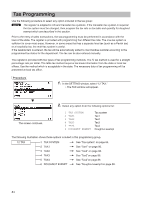

Sample tax table Example 8% Tax Minimum breakpoint .00 .01 .01 .11 .02 .26 .03 .47 .04 .68 .06 .89 .09 1.11 .10 1.26 .11 1.47 .12 1.68 .14 1.89 .17 2.11 Modification of the left tax table Tax .00 .01 T .02 .03 .04 .05 .06 .07 .08 .09 .10 .11 .12 .13 .14 .15 .16 .17 Minimum breakpoint .01 .11 Q .26 .47 .68 .89 .89 1.11 M1 1.11 1.11 1.26 1.47 1.68 1.89 1.89 2.11 M2 2.11 2.11 Breakpoint difference (¢) 1 10 (0.11-0.01) 15 (0.26-0.11) 21 (0.47-0.26) 21 (0.68-0.47) 21 (0.89-0.68) 0 (0.89-0.89) 22 (1.11-0.89) 0 (1.11-1.11) 0 (1.11-1.11) 15 (1.26-1.11) 21 (1.47-1.26) 21 (1.68-1.47) 21 (1.89-1.68) 0 (1.89-1.89) 22 (2.11-1.89) 0 (2.11-2.11) 0 (2.11-2.11) B: Non-cyclic C: Cyclic-1 D: Cyclic-2 Example data of above tax table (8%) TAX RATE: 8.0000 (enter 8) CYCLE: 1.00 (enter 100) INITIAL TAX: 0.01 (enter 1) LOWER TAX: 0.11 (enter 11) BREAK POINT1: 0.26 (enter 26) BREAK POINT2: 0.47 (enter 47) BREAK POINT3: 0.68 (enter 68) BREAK POINT4: 0.89 (enter 89) BREAK POINT5: 0.89 (enter 89) BREAK POINT6: 1.11 (enter 111) BREAK POINT7: 1.11 (enter 111) BREAK POINT8: 1.11 (enter 111) • % Tax Procedure Program each item as follows: • TAX RATE (Use the numeric entry) Tax rate (max. 7 digits: 0.0000 to 999.9999%). • LOWER TAX (Use the numeric entry) Lowest taxable amount (max. 5 digits: 0.00 to 999.99). ■■ Doughnut exempt Procedure Program each item as follows: • QUANTITY (Use the numeric entry) Quantity for doughnut tax exempt (2 digits: 1 to 99/0). NOTE The programming is effective for "taxable 1 & taxable 3" items on Canadian tax (CANADA TAX 01 or CANADA TAX 10). 88