Sharp XE-A42S XE-A42S Operation Manual in English and Spanish - Page 37

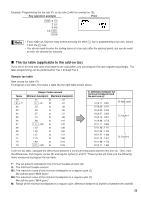

in the following manner., Sample tax table, Modification of the left tax table, Example 8

|

View all Sharp XE-A42S manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 37 highlights

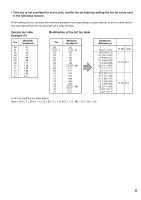

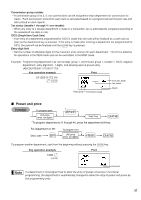

• If the tax is not provided for every cent, modify the tax table by setting the tax for every cent in the following manner. When setting the tax, consider the minimum breakpoint corresponding to unprovided tax to be the same as the one corresponding to the tax provided on a large amount. Sample tax table Example 8% Minimum Tax breakpoint .00 .01 .01 .11 .02 .26 .03 .47 .04 .68 .06 .89 .09 1.11 .10 1.26 .11 1.47 .12 1.68 .14 1.89 .17 2.11 Modification of the left tax table Tax .00 .01 T .02 .03 .04 .05 .06 .07 .08 .09 .10 .11 .12 .13 .14 .15 .16 .17 Minimum breakpoint .01 .11 Q .26 .47 .68 .89 .89 1.11 M1 1.11 1.11 1.26 1.47 1.68 1.89 1.89 2.11 M2 2.11 2.11 Breakpoint difference (¢) 1 10 (0.11-0.01) 15 (0.26-0.11) 21 (0.47-0.26) 21 (0.68-0.47) 21 (0.89-0.68) 0 (0.89-0.89) 22 (1.11-0.89) 0 (1.11-1.11) 0 (1.11-1.11) 15 (1.26-1.11) 21 (1.47-1.26) 21 (1.68-1.47) 21 (1.89-1.68) 0 (1.89-1.89) 22 (2.11-1.89) 0 (2.11-2.11) 0 (2.11-2.11) B: Non-cyclic C: Cyclic-1 D: Cyclic-2 From the modified tax table above; Rate = 8(%), T = $0.01 = 1¢, Q = $0.11 = 11¢, M1 = 1.11, M2 = 2.11, M = 100 35