Sharp XEA102 XE-A102 Operation Manual in English and Spanish - Page 1

Sharp XEA102 - Cash Register Manual

|

UPC - 074000049093

View all Sharp XEA102 manuals

Add to My Manuals

Save this manual to your list of manuals |

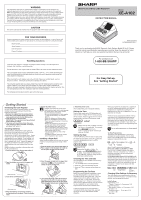

Page 1 highlights

WARNING FCC Regulations state that any unauthorized changes or modifications to this equipment not expressly approved by the manufacturer could void the user's authority to operate this equipment. Note: This equipment has been tested and found to comply with the limits for a Class A digital device, pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful interference when this equipment is operated in a commercial environment. This equipment generates, uses, and can radiate radio frequency energy and, if not installed and used in accordance with the instruction manual, may cause harmful interference to radio communications. Operation of this equipment in a residential area is likely to cause harmful interference in which case the user will be required to correct the interference at his own expense. CAUTION The socket-outlet shall be installed near the equipment and shall be easily accessible. FOR YOUR RECORDS Please record below the model number and serial number, for easy reference, in case of loss or theft. These numbers are located on the right side of the unit. Space is provided for further pertinent data. Model Number Serial Number Date of Purchase Place of Purchase Handling Cautions Install the cash register in a location not subject to direct sunlight, unusual temperature changes, high humidity, or splashing water. Do not operate the cash register with wet hands. Water can cause internal component failure. The cash register plugs into any standard wall outlet (120V AC ± 10%). Avoid connecting any other electrical devices on the same electrical circuit since such connection could cause the cash register to malfunction. When cleaning the cash register, use a dry, soft cloth. Never use volatile liquids, such as benzine or thinner. Chemicals can discolor or damage the cabinet. For protection against data loss, please install three new "AA" batteries before using the cash register. However, never forget you must initialize the cash register before installation of batteries; otherwise damage to memory contents or malfunctioning of the register will occur. You can start operating it only after initializing it and then installing batteries. For complete electrical disconnection, pull out the main plug. SHARP ELECTRONIC CASH REGISTER MODEL XE-A102 INSTRUCTION MANUAL Printed in China O(TINSE2539RCZZ) 1 Thank you for purchasing the SHARP Electronic Cash Register Model XE-A102. Please read this manual carefully before operating your machine. Keep this manual for future reference. It will help you solve any operational problems that you may encounter. For assistance call 1-800-BE-SHARP For Easy Set-up, See "Getting Started" Getting Started Initializing the Cash Register For your cash register to operate properly, you must initialize it before programming for the first time. Follow this procedure. 1. Remove the register from its packing carton. 2. Insert one of the supplied mode keys into the mode switch and turn it to the REG position. 3. Insert the plug into the AC outlet. IMPORTANT: This operation must be performed without batteries loaded. 4. The buzzer will sound three times. Now your cash register has been initialized. The display will show "0.00" with " ". Installing Batteries Batteries must be installed in the cash register to prevent data and programmed contents from being lost from the memory in case of accidental disconnection of the AC cord or power failure. Please install three new "AA" batteries before programming and operating the cash register. Once installed, the batteries will last approximately one year. When it is time to replace them, the "l" symbol will appear on the display to indicate a low battery voltage. If the symbol appears, you must replace them within two days. Install the batteries according to this procedure with the AC cord connected: 1. Push the printer cover forward and detach it. 5. Attach the printer cover. C Improper use of batteries could cause them to burst or leak, which might damage the interior of the cash register. Please take the following precautions: •Be sure that the positive (+) and negative (-) poles of each battery are oriented properly. •Never mix batteries of different types. •Never mix old batteries and new ones. •Never leave dead batteries in the battery compartment. •Remove the batteries if you plan not to use the cash register for long periods. •Should a battery leak, clean out the battery compartment immediately, taking care not to let the battery fluid come into direct contact with your skin. •If an incorrect battery is used, it may explode or leak. •For battery disposal, follow the relevant law or regulation in your country. Installing a Paper Roll Always install the paper roll even when you set the register for not printing journal or receipt in REG mode. 1. Push the printer cover forward and detach it. 2. Place a paper roll in the paper roll cradle so that the paper unrolls from the bottom. 2. Open the battery cover next to the paper roll cradle. 3. Insert the paper straight into the paper inlet, and press the f key. The inserted end comes out at the printing area. View from rear 3. Insert three new AA batteries. 4. (For journal printing) Insert the top end of the paper into the slit in the take-up spool shaft and wind the paper two or three turns. Then place the take-up spool on the bearing. View from rear 4. When the batteries are properly installed, " " on the display will disappear. Close the battery cover. 5. Attach the printer cover. (For receipt printing, step 4 should be omitted.) Setting the Time Turn the mode switch to the Z/PGM position and enter the time in 4 digits ("hhmm" format) using the 24 hour system. Press the #/ SBTL key once to continue programming or twice to exit the program mode. #/ SBTL #/ SBTL Time (2:30 p.m.) D •Always enter the time in 4 digits even when the hour is in the single digit. For example, enter 0 6 3 0 for 6:30 a.m. • 6:30 a.m. prints as "06-30" and 6:30 p.m. prints as "06-30@". Setting the Date In the Z/PGM mode, enter the date in 6 digits using the month-day-year format. Press the #/ SBTL key once to continue programming or twice to exit the program mode. #/ #/ SBTL SBTL Date (March 15, 2006) D Always enter the date in 6 digits. For example, enter 0 3 1 5 0 6 for March 15, 2006. If you change the date format in the Z/PGM mode, follow the newly specified format when setting the date. Checking the Time and Date You can display the time and date to check if they are correctly set. 1. Turn the mode switch in the REG position. 2. Press the @/TM key once to display the time. 3. Press the @/TM key a second time to display the date. Programming the Tax Rate Before you can proceed with registration of sales, you must first program the tax that is levied in accordance with the law of your state. Your cash register comes with the ability to program four different tax rates. In most states, you will only need to program Tax 1. However, if you live in an area that has a separate local tax (such as a Parish tax) or a hospitality tax, your register can be programmed to calculate these separate taxes. In order to program the tax to be collected in accordance with the law of your state, you must specify the tax rate(s) and minimum taxable amount(s). When you program the tax status for a department, tax will be automatically added to sales of items assigned to the department according to the programmed tax status for the department. You can also enter tax manually. There are two tax programming methods. The tax rate method uses a straight percentage rate per dollar. The tax table method requires tax break information from your state or local tax offices. Use the method which is acceptable in your state. You can obtain necessary data for tax programming from your local tax office. D For tax table programming, see "programming" Tax Rate Programming The percent rate specified here is used for tax calculation on taxable subtotals. Turn the mode switch to the Z/PGM position and use the following sequence to program the tax rate: 9 ➝ #/ SBTL ➝ Tax number(1-4) ➝ @/TM ➝ R ➝ @/TM ➝ Q ➝ where R and Q represent the following. R: Tax rate (0.0000% to 99.9999%) x 10000 Enter the rate in 6 digits (leading zeros may be omitted). If the rate is fractional (e.g., 4 3/8%), it should be converted to its decimal equivalent (4.375) before entering. Q: Minimum taxable amount (0.01 to 99.99) x 100 Smallest amount for which tax must be collected. In some states, sales whose amounts are less than the minimum taxable amount are not subject to tax. If amounts $0.01 to $0.10 are not taxed, the value of Q would be 11 (for $0.11), the lowest of the first taxable category. #/ SBTL @/TM @/TM Tax 1 Tax rate (7.0000%) Min. taxable amount ($0.11) Changing Other Settings As Necessary Your cash register is pre-programmed so that you can use it with minimum setup. To change the initial settings, see the appropriate sections. Initial Settings Departments 1 to 4: Taxable 1. Positive (+). Preset price: 0.00 Departments 5 to 8: Non-taxable. Positive (+). Preset price: 0.00 PLU codes 1-10: Assigned to dept. 1. Preset price: 0.00 PLU codes 11-80: Not used