Sharp XEA21S Instruction Manual - Page 32

Time, 2 Tax Programming for Automatic Tax Calculation Function, Tax programming using a tax rate - support

|

UPC - 074000049260

View all Sharp XEA21S manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 32 highlights

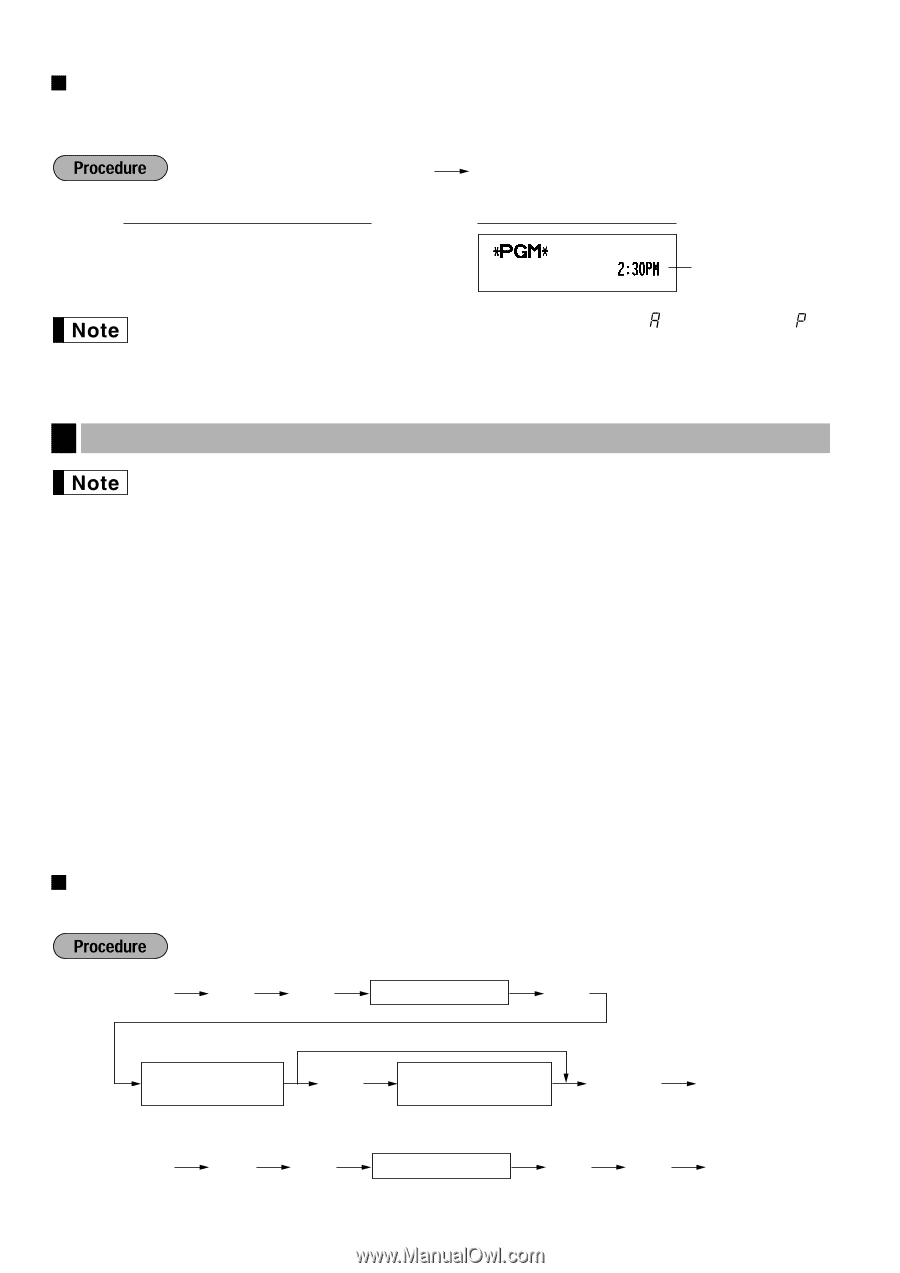

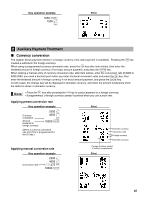

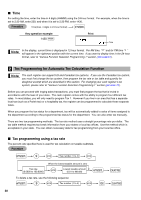

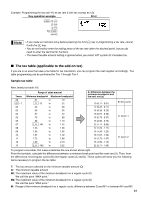

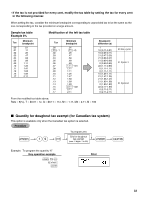

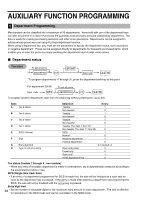

Time For setting the time, enter the time in 4 digits (HHMM) using the 24-hour format. For example, when the time is set to 2:30 AM, enter 230; and when it is set to 2:30 PM, enter 1430. Time(max. 4 digits in 24-hour format) s Key operation example 1430 s Print Time In the display, current time is displayed in 12-hour format. For AM time, " " and for PM time " " will appear in the rightmost position with the current time. If you want to display time in the 24-hour format, refer to "Various Function Selection Programming 1" section (Job code 61). 2 Tax Programming for Automatic Tax Calculation Function The cash register can support US and Canadian tax systems. If you use the Canadian tax system, you must first change the tax system, then program the tax rate or tax table and quantity for doughnut exempt which are described in this section. For changing your cash register's tax system, please refer to "Various Function Selection Programming 1" section (job code 70). Before you can proceed with ringing sales transactions, you must first program the tax that is levied in accordance with the laws of your state. The cash register comes with the ability to program four different tax rates. In most states, you will only need to program Tax 1. However if you live in an area that has a separate local tax (such as a Parish tax) or a hospitality tax, the register can be programmed to calculate these separate taxes. When you program the tax status for a department, tax will be automatically added to sales of items assigned to the department according to the programmed tax status for the department. You can also enter tax manually. There are two tax programming methods. The tax rate method uses a straight percentage rate per dollar. The tax table method requires tax break information from your states or local tax offices. Use the method which is acceptable in your state. You can obtain necessary data for tax programming from your local tax office. Tax programming using a tax rate The percent rate specified here is used for tax calculation on taxable subtotals. s 9@ Tax number (1 to 4) @ Tax rate (0.0000 to 100.0000) When the lowest taxable amount is zero @ Lowest taxable amount (0.01 to 999.99) s To delete a tax rate, use the following sequence: s 9 @ Tax number (1 to 4) @v A A 30