Sharp XEA21S Instruction Manual - Page 54

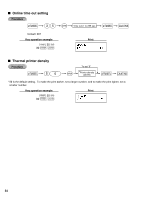

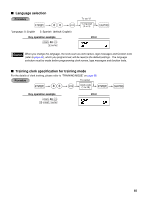

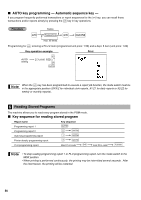

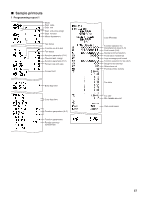

Job code, Selection, Entry, Tax calculation system

|

UPC - 074000049260

View all Sharp XEA21S manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 54 highlights

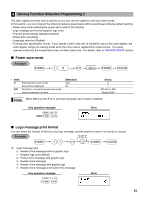

Job code: 70 * Item: A B C D E F GH Selection: Split pricing counting Quantity* Package Multiplication/split pricing entry availability Allow multiplication entry only* Allow both of multiplication and split pricing Always enter 0. (Fixed position) Always enter 0. (Fixed position) Tax printing when GST is VAT Allow tax printing* Disallow it GST exempt printing on X/Z reports Allow printing of GST exempt* Disallow it Tax calculation system Auto tax* Canadian tax (tax type number) Entry: 0 1 0 1 0 0 0 1 0 1 00 01 through 11 Tax calculation system • For US tax system, select "auto-tax". • For Canadian tax, from the table below, specify a tax system suitable for your province (if necessary contact your local tax office for correct sales tax information) and for your type of retail business. In the cash register, four kinds of tax can be set and each tax is arranged to match GST or PST as follows: Tax 1: PST Tax 2: PST Tax 3: PST or GST Tax 4: GST Canadian tax type number 01 02 03 04 05 06 07 08 09 10 11 Tax 4 method GST VAT VAT VAT VAT Add on Tax Add on Tax Add on Tax Add on Tax Add on Tax Add on Tax VAT GST Tax 3 method PST VAT - VAT - - Tax on tax - Tax on base - Tax on tax - Tax on base VAT - VAT - Add on Tax - Add on Tax - - VAT (Tax on base) Tax 2 and 1 method PST Tax on tax Tax on base Tax on tax Tax on base Tax on Tax Tax on base Tax on tax Tax on base Tax on tax Tax on base Tax on tax (The most common type for Canada is type number 06.) • To program a GST, use Tax 4; and to program two GSTs, use Tax 3 and 4. To program a PST, use Tax 1; to program two PSTs, use Tax 1 and 2; and to program three PSTs, use Tax 1, 2 and 3. • The entry of a multi-taxable item for PST or GST is prohibited as follows for the Canadian tax system. When programming for departments, avoid programming the prohibited multi-taxable status. In case of; Tax 1: PST, Tax 2: PST, In case of; Tax 1: PST, Tax 2: PST, Tax 3: PST, Tax 4: GST Tax 3: GST, Tax 4: GST Taxable 1 and 2 item prohibited Taxable 1 and 2 item prohibited Taxable 1 and 3 item prohibited Taxable 1 and 3 item allowed Taxable 2 and 3 item prohibited Taxable 2 and 3 item allowed Taxable 1 and 4 item allowed Taxable 1 and 4 item allowed Taxable 2 and 4 item allowed Taxable 2 and 4 item allowed 52 Taxable 3 and 4 item allowed Taxable 3 and 4 item prohibited