HP F2227AA#ABA User Guide - Page 21

Margin

|

UPC - 884420048763

View all HP F2227AA#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

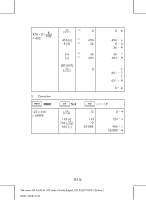

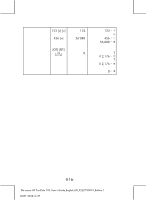

Page 21 highlights

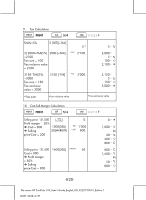

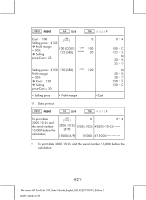

9. Tax Calculation PRINT 5/4 A 0 2 3 F TAX%=5% 5 [SET][+TAX] 5.% 5 % 2) 2000+TAX(5%) 2000 [+TAX] =2100 Tax sum = 100 Tax inclusive value = 2100 +TAX 2'100. 2,000 5 % 100 2,100 3150-TAX(5%) =3000 Tax sum = 150 Tax exclusive value = 3000 3150 [-TAX] -TAX 3'000. 3,150 5 % -150 3,000 •Tax sum •Tax inclusive value •Tax exclusive value 10. Cost-Sell-Margin Calculation PRINT 5/4 A 0 2 3 F Selling price:$1,000 Profit margin: 20% [CO/CNE] Cost = 800 1000[SELL] Selling 20[MARGIN] price-Cost = 200 0. SELL 1'000 COST 800. Selling price:$1,600 1600[SELL] MARGIN% 50. Cost = 800 Profit margin = 50% Selling price-Cost = 800 0 1,000 S M 20 % 200 800 C 800 C 1,600 S M 50 % 800 -E20- File name: HP PrintCalc 100_User's Guide_English_EN_F2227-90001_Edition 1 DATE: 2008/6/27