HP F2231AA User Guide - Page 45

Basic Financial Functions

|

UPC - 088698000120

View all HP F2231AA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 45 highlights

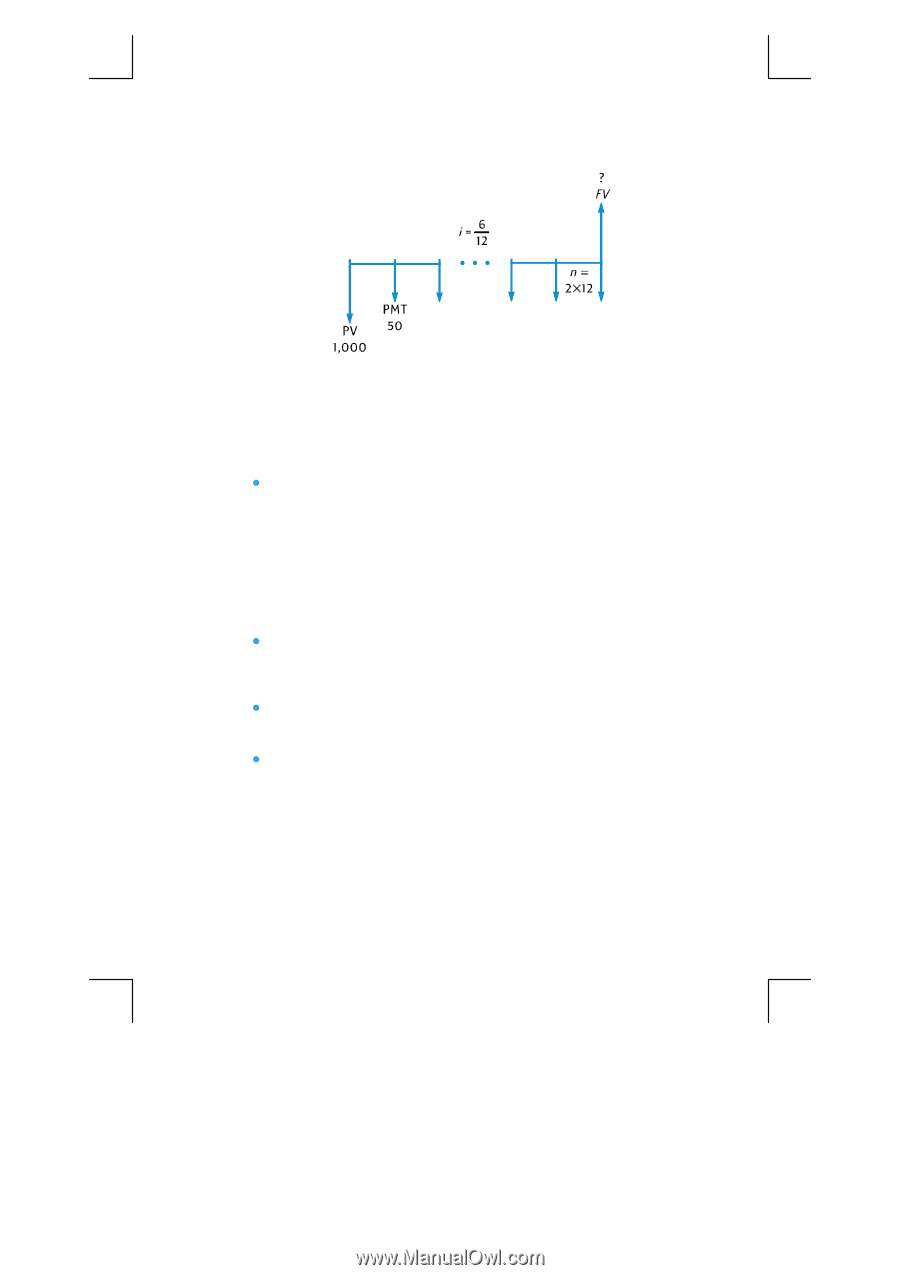

Section 3: Basic Financial Functions 45 The arrow pointing up at the right of the diagram indicates that money is received at the end of the transaction. Every completed cash flow diagram must include at least one cash flow in each direction. Note that cash flows corresponding to the accrual of interest are not represented by arrows in the cash flow diagram. The quantities in the problem that correspond to the first five keys on the top row of the keyboard are now readily apparent from the cash flow diagram. z n is the number of compounding periods. This quantity can be expressed in years, months, days, or any other time unit, as long as the interest rate is expressed in terms of the same basic compounding period. In the problem illustrated in the cash flow diagram above, n = 2 × 12. The form in which n is entered determines whether or not the calculator performs financial calculations in Odd-Period mode (as described on pages 63 through 67). If n is a noninteger (that is, there is at least one nonzero digit to the right of the decimal point), calculations of i, PV, PMT, and FV are performed in Odd-Period mode. z i is the interest rate per compounding period. The interest rate shown in the cash flow diagram and entered into the calculator is determined by dividing the annual interest rate by the number of compounding periods. In the problem illustrated above, i = 6% ÷ 12. z PV - the present value - is the initial cash flow or the present value of a series of future cash flows. In the problem illustrated above, PV is the $1,000 initial deposit. z PMT is the period payment. In the problem illustrated above PMT is the $50 deposited each month. When all payments are equal, they are referred to as annuities. (Problems involving equal payments are described in this section under Compound Interest Calculations; problems involving unequal payments can be handled as described in under Discounted Cash Flow Analysis: NPV and IRR. Procedures for calculating the balance in a savings account after a series of irregular and/or unequal deposits are included in the hp 12c platinum Solutions Handbook.) File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 45 of 275 Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm