HP OfficeCalc 200 HP OfficeCalc 200 Calculator User Guide - Page 11

Price Mark-Up & Down Calculation, Tax Calculation

|

View all HP OfficeCalc 200 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 11 highlights

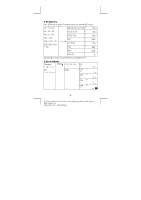

7.Price Mark-Up & Down Calculation 20+(Px20%)=P P= 1 20 − 20% =25 A• 0• 2• 3• 4• F• 20 [MU] 20 [%] = 01 03 GT 04 GT 125-(Px25%)=P P= 125 =100 1 + 25% • 5/•4 • 125 [MU] 01 25 [+/-] [%] 03 GT 04 GT 20. MU 25.00 % 5.00 = 125. MU 100.00 % -25.00 = 8.Tax Calculation 150+TAX(3%) =154.5 3 [RATE] 01 Tax sum = 4.5 [ ] STORE +TAX 01 Tax inclusive value = 154.5 150 [ STORE +TAX ] 01 A• 0• 2• 3• 4• F• [ ] STORE +TAX 01 206-TAX(3%) =200 Tax sum = 6 5/4 ••• [ON/C] [RATE] 01 [ ] RECALL -TAX 206 [ RECALL -TAX ] 01 Tax exclusive value = 200 [ ] RECALL -TAX 01 RATE 3. % 3. +TAX 154.50 TAX 4.50 % 3. -TAX 200.00 TAX 6.00 -10- File name: HP OfficeCalc 200_User's Guide_English_EN_F2221-90001_Edition 1 DATE: 2008/5/13 KINPO PARTS NO.: HDP0520HE06

-10-

File name: HP OfficeCalc 200_User's Guide_English_EN_F2221-90001_Edition 1

DATE: 2008/5/13

KINPO PARTS NO.:

HDP0520HE06

7.Price Mark-Up & Down Calculation

01

20

.

MU

03

GT

25.00

%

20+(Px20%)=P

P=

%

20

1

20

−

=25

20 [MU]

20 [%]

=

04

GT

5.00

=

01

125

.

MU

03

GT

100.00

%

125–(Px25%)=P

P=

%

25

1

125

+

=100

•

•

•

•

•

•

A 0 2 3 4 F

•

•

•

5/4

125 [MU]

25 [+/–] [%]

04

GT

-25.00

=

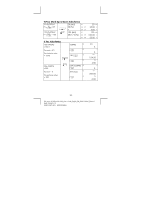

8.Tax Calculation

01

RATE

3 [RATE]

3.

01

%

[

STORE

+

TAX

]

3.

01

+TAX

150 [

STORE

+

TAX

]

154.50

01

TAX

150+TAX(3%)

=154.5

Tax sum = 4.5

Tax inclusive value

= 154.5

[

STORE

+

TAX

]

4.50

01

%

[ON/C] [RATE]

[

RECALL

-

TAX

]

3.

01

–TAX

206 [

RECALL

-

TAX

]

200.00

01

TAX

206–TAX(3%)

=200

Tax sum = 6

Tax exclusive value

= 200

•

•

•

•

•

•

A 0 2 3 4 F

•

•

•

5/4

[

RECALL

-

TAX

]

6.00