Sharp CS-2870 CS-2870 Operation Manual - Page 25

Annual, Quarterly, Principal, balance

|

View all Sharp CS-2870 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 25 highlights

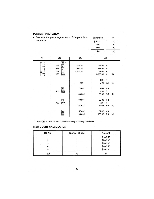

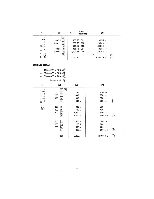

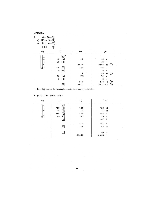

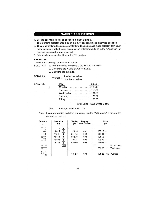

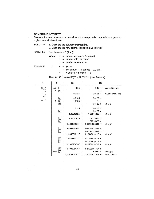

COMPOUND INTEREST Calculate the new balance on a deposit which is compounded quarterly for 4 years at a given annual interest rate. SOLUTION: 1. Calculate the quarterly interest rate. 2. Calculate the new balance (principal plus interest) FORMULA: New balance = P (1 + Where P = amount of deposit (principal) = interest rate per period n = number of years x 4 EXAMPLE: If P = $6,150 i = 5% annum ÷ 4 periods = 0.0125 n = 4 years x 4 periods = 16 Then 6,150 (1 + 0.0125)76 $7,502.32 (New Balance) (1) (2) (3) (4) ffif -F -6 -5 -4 -3 -2 -1 -o .05 4 1 0.05 0.0125 0.0125 1.0125 0.05 4. = 0.0125 * 0.0125 + 1• + 1.0125 0 Annual int. rate Quarterly int. rate (1 +i) 1.0125 O 1.02515625 O 1.02515625 1.05094533691 1.0125 x 1.0125 = 1.02515625 * 1.02515625 x 1.02515625 = 1.05094533691 * (1 + i)2 (1 + i)4 1.05094533691 E1 1.10448610117 1.05094533691 x 1.05094533691 = 1.10448610117 * (1 + 1)8 1.10448610117 1.21988954767 1.10448610117 x 1.10448610117 = 1.21988954767 * (1 + 016 6150 El 1.21988954767 7,502.32071817 1.21988954767 x 6150• = 7,502.32071817 *- Principal New balance 23