Sharp EL733A EL-733A Operation Manual - Page 36

reflection

|

View all Sharp EL733A manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 36 highlights

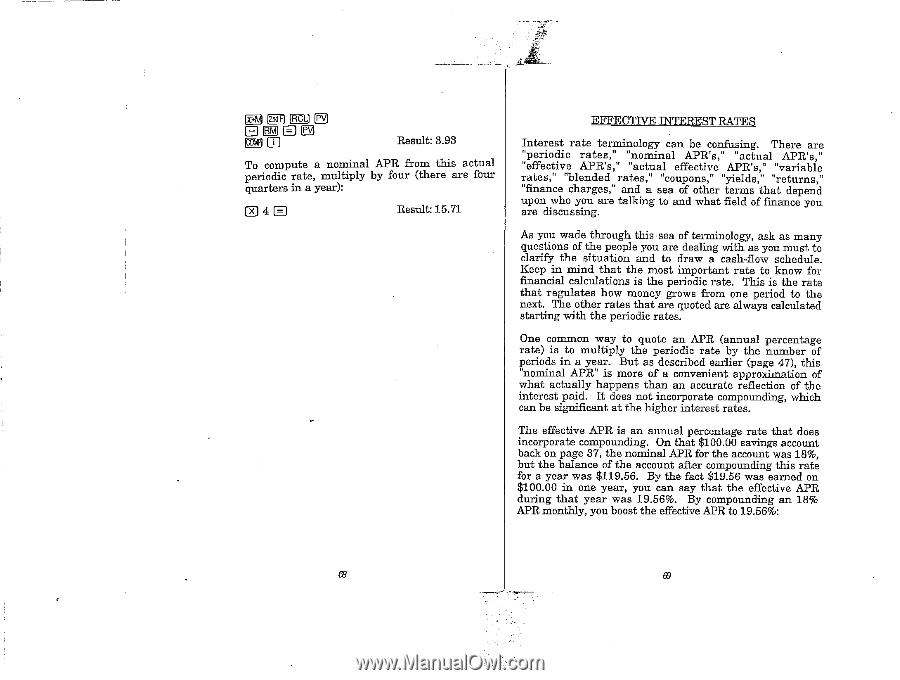

Vann) Fin mai t j inmi0 E Result: 3.93 To compute a nominal APR from this actual periodic rate, multiply by four (there are four quarters in a year): 0 40 Result: 15.71 ECTIVE INTEREST RATES Interest rate terminology can be confusing. There are "periodic rates," "nominal APR's," "actual APR's," "effective APR's," "actual effective APR's," "variable rates," "blended rates," "coupons," "yields," "returns," "finance charges," and a sea of other terms that depend upon who you are talking to and what field of finance you are discussing. As you wade through this sea of terminology, ask as many questions of the people you are dealing with as you must to clarify the situation and to draw a cash-flow schedule. Keep in mind that the most important rate to know for financial calculations is the periodic rate. This is the rate that regulates how money grows from one period to the next. The other rates that are quoted are always calculated starting with the periodic rates. One common way to quote an APR (annual percentage rate) is to multiply the periodic rate by the number of periods in a year. But as described earlier (page 47), this "nominal APR" is more of a convenient approximation of what actually happens than an accurate reflection of the interest paid. It does not incorporate compounding, which can be significant at the higher interest rates. The effective APR is an annual percentage rate that does incorporate compounding. On that $100.00 savings account back on page 37, the nominal APR for the account was 18%, but the balance of the account after compounding this rate for a year was $119.56. By the fact $19.56 was earned on $100.00 in one year, you can say that the effective APR during that year was 19.56%. By compounding an 18% APR monthly, you boost the effective APR to 19.56%: