Sharp EL733A EL-733A Operation Manual - Page 67

ndfl

|

View all Sharp EL733A manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 67 highlights

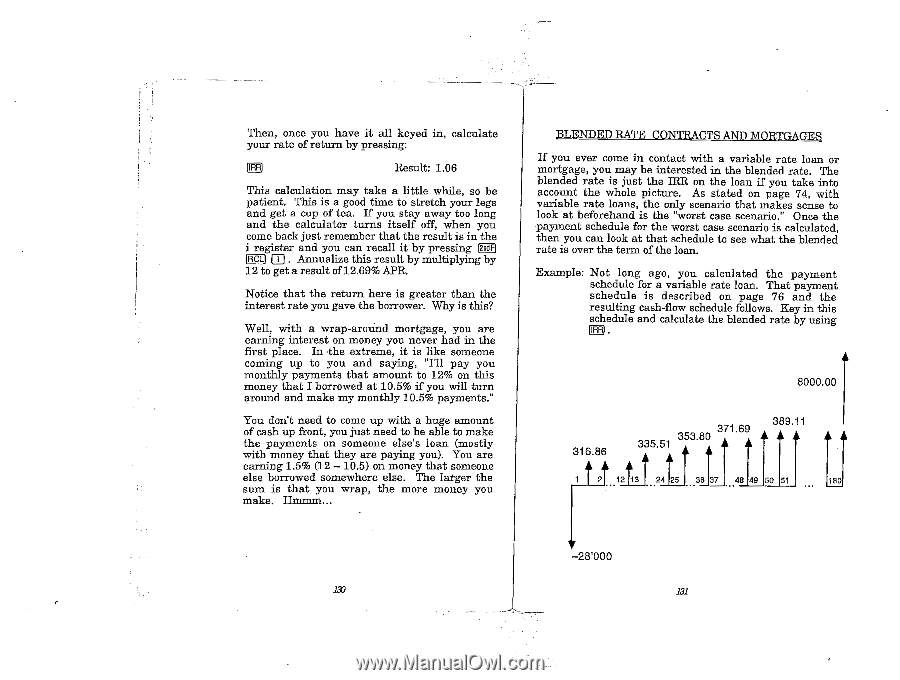

Then, once you have it all keyed in, calculate your rate of return by pressing: Result: 1.06 This calculation may take a little while, so be patient. This is a good time to stretch your legs and get a cup of tea. If you stay away too long and the calculator turns itself off, when you come back just remember that the result is in the i register and you can recall it by pressing 12ndfl M . Annualize this result by multiplying by 12 to get a result of 12.69% APR. Notice that the return here is greater than the interest rate you gave the borrower. Why is this? Well, with a wrap-around mortgage, you are earning interest on money you never had in the first place. In /the extreme, it is like someone coming up to you and saying, "I'll pay you monthly payments that amount to 12% on this money that I borrowed at 10.5% if you will turn around and make my monthly 10.5% payments." You don't need to come up with a huge amount of cash up front, you just need to be able to make the payments on someone else's loan (mostly with money that they are paying you). You are earning L5% (12 - 10.5) on money that someone else borrowed somewhere else. The larger the sum is that you wrap, the more money you make. Hmmrn BLENDED BAIT, COWL RACTS AND MORTGAGES If you ever come in contact with a variable rate loan or mortgage, you may be interested in the blended rate. The blended rate is just the IRR on the loan if you take into account the whole picture. As stated on page 74, with variable rate loans, the only scenario that makes sense to look at beforehand is the "worst case scenario." Once the payment schedule for the worst case scenario is calculated, then you can look at that schedule to see what the blended rate is over the term of the loan. Example: Not long ago, you calculated the payment schedule for a variable rate loan. That payment schedule is described on page 76 and the resulting cash-flow schedule follows. Key in this schedule and calculate the blended rate by using [FIFO 8000.00 316.86 371.69 353.80 335.51 389.11 t 2t 2t3 t 24x25 j 3637 j 48 49 50 51 180 -28'000 130 131