Sharp UP-700 Instruction Manual - Page 50

VAT shift entries

|

View all Sharp UP-700 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 50 highlights

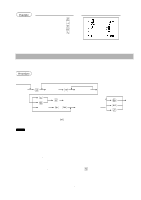

Manual tax 1 through 6 system (Manual entry method using programmed percentages) Procedure sz This system provides the tax calculation for taxable 1, taxable 2, taxable 3, taxable 4, taxable 5, and taxable z 6 subtotals. This calculation is performed using the corresponding programmed percentages when the s key is pressed just after the key. After this calculation, you must finalize the transaction. Automatic VAT 1 through 3 and tax 4 through 6 system This system enables the calculation in the combination with automatic VAT 1 through 3 and tax 4 through 6. This combination can be any of VAT 1 through 3 and tax 4 through 6. The tax amount is calculated automatically with the percentages previously programmed for these taxes. NOTE VAT/tax assignment is printed at the fixed right position of the amount on the receipt and bill as follows: VAT1/tax1 A VAT2/tax2 B VAT3/tax3 C VAT4/tax4 D VAT5/tax5 E VAT6/tax6 F When the multiple VAT/tax is assigned to a department or a PLU, a smaller number of the VAT/tax will be printed. For details, contact your authorized SHARP dealer. Example Key operation (When the manual 8 VAT 1 through 6 s system is selected) z c Print s VAT shift entries This feature is intended to shift the tax status of a particular department (or PLU) programmed for taxable 1 or taxable 1 and taxable 3. 1. When the VAT shift entry is made for a particular department or PLU programmed for taxable 1, their tax status shifts to taxable 2. 2. When this entry is made for a particular department (or PLU) programmed for taxable 1 and taxable 3, the tax status "taxable 1" remains unchanged, but the other, "taxable 3" is ignored. Procedure Z Press the key to activate the VAT shift prior to entering department(s) or PLU(s) concerned. If you want to activate the VAT shift at the end of an entry, contact your authorized SHARP dealer. 48