Texas Instruments BAIIPlus User Manual - Page 41

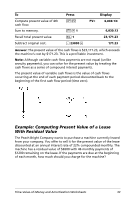

Example: Computing Regular Deposits for a Specified Future Amount

|

UPC - 033317000296

View all Texas Instruments BAIIPlus manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 41 highlights

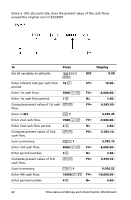

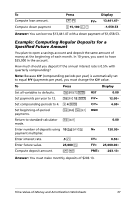

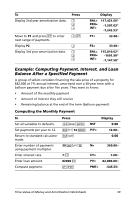

To Compute loan amount. Compute down payment Press % . PV= H 15,100 S N Display 13,441.47 -1,658.53 Answer: You can borrow $13,441.47 with a down payment of $1,658.53. Example: Computing Regular Deposits for a Specified Future Amount You plan to open a savings account and deposit the same amount of money at the beginning of each month. In 10 years, you want to have $25,000 in the account. How much should you deposit if the annual interest rate is 0.5% with quarterly compounding? Note: Because C/Y (compounding periods per year) is automatically set to equal P/Y (payments per year), you must change the C/Y value. To Press Set all variables to defaults. & } ! Set payments per year to 12. & [ 12 ! Set compounding periods to 4. # 4 ! Set beginning-of-period payments. &] &V Return to standard-calculator & U mode. Enter number of deposits using 10 & Z , payment multiplier. Enter interest rate. .5 - Enter future value. 25,000 0 Compute deposit amount. % / Display RST 0.00 P/Y= C/Y= 12.00 4.00 BGN 0.00 N= 120.00 I/Y= 0.50 FV= 25,000.00 PMT= -203.13 Answer: You must make monthly deposits of $203.13. Time-Value-of-Money and Amortization Worksheets 37