Casio PCR-26S Owners Manual - Page 12

Part-1, Quick Start Operation

|

UPC - 079767507251

View all Casio PCR-26S manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 12 highlights

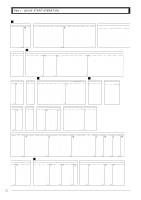

Part-1 QUICK START OPERATION Mode Switch RF PGM X CAL REG OFF Z Procedure Example 2: Set Colorado state tax 5.25%. Ck ?XXBk B"XBp B??Xp k P3 appears in mode display Program set code No. for Tax table 2 5.25% tax 50 for Round off and 02 for Add On (to end the setting) • Tax table 2 programming can set only tax rate, but not for a tax break point. 4. For CANADA Find the tax table for your province on page 16 of this manual. Press the following keys to set the tax tables 1 and 2. Example 1: Set Quebec tax 9%. Ck ?ZXBk >p >??Xp k P3 appears in mode display Program set code No. for tax table 1 9% tax 90 for round up and 02 for Add On. (to end the setting) • Tax table 1 programming is used for the tax table includes break points and tax rate. Example 2: Set Ontario tax 10%. Ck ?XXBk Z?p B??Vp k P3 appears in mode display Program set code No. for tax table 2 10% tax rate 50 for Round off and 04 for tax on tax code (to end the setting) Purpose Setting the Tax table 2 COLORADO 5.25% 5.25 5002 Setting the Tax table 1 CANADA QUEBEC 9% 9 9002 Setting the Tax table 2 CANADA ONTARIO 10% 10 5004 • Tax table 2 programming can set tax rate and the tax table includes Tax-on Tax code (5004) as above example, but not for a tax break point. Tax status for the Departments are fixed as follows: Department 2: Taxable status 1 and 2. Departments 1, 3~10: Non-Taxable status. • See page 22 to change the fixed tax status. E 12