HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 60

Profit and Loss Analysis - calculator simulator

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 60 highlights

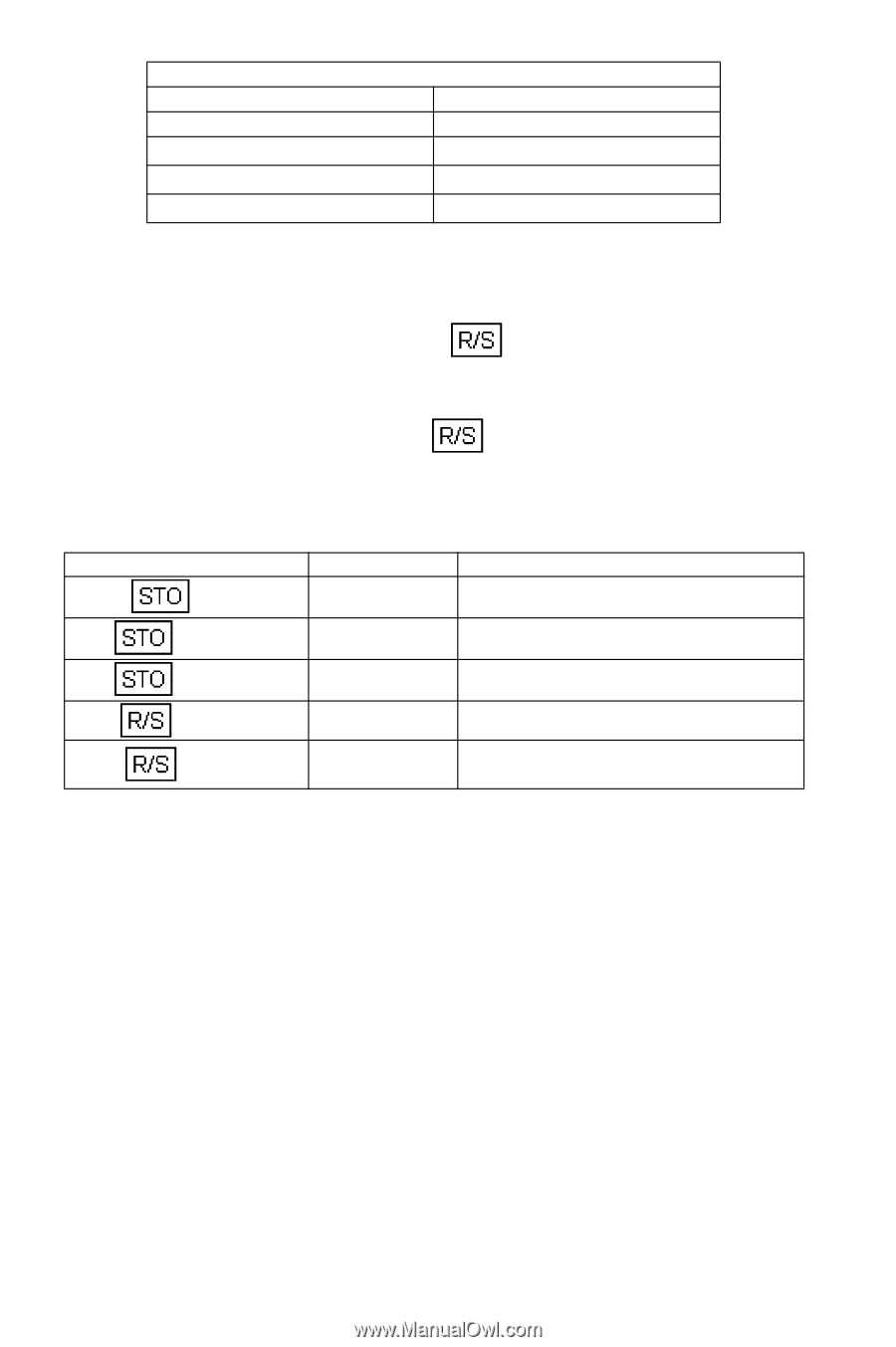

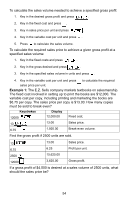

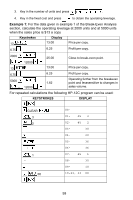

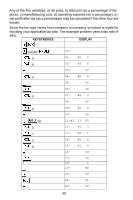

n: Unused PV: Unused FV: Unused R1: F R3: P REGISTERS i: Unused PMT: Unused R0: Unused R2: V R4-R.8: Unused 1. Key in the program. 2. Key in and store input variables F, V and P as described in the Break-Even Analysis program. 3. Key in the sales volume and press to calculate the operating leverage. 4. To calculate a new operating leverage at a different sales volume, key in the new sales volume and press Example 2: For the figures given in example 2 of the Break-Even Analysis section, calculate the operating leverage at a sales volume of 9,000 and 20,000 units if the sales price is $12.50 per unit. Keystrokes 35000 1 8.25 2 12.5 3 9000 20000 Display 35,000.00 8.25 12.50 11.77 1.70 Fixed costs. Variable cost. Sales price. Operating leverage near break-even. Operating leverage further from break-even. Profit and Loss Analysis The HP-12C may be programmed to perform simplified profit and loss analysis using the standard profit income formula and can be used as a dynamic simulator to quickly explore ranges of variables affecting the profitability of a marketing operation. The program operates with net income return and operating expenses as percentages. Both percentage figures are based on net sales price. It may also be used to simulate a company wide income statement by replacing list price with gross sales and manufacturing cost with cost of goods sold. 59