HP 12C#ABA hp 12c_solutions handbook_English_E.pdf - Page 66

Securities, After-Tax Yield

|

UPC - 492410746430

View all HP 12C#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 66 highlights

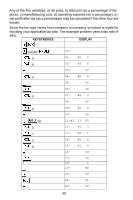

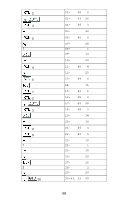

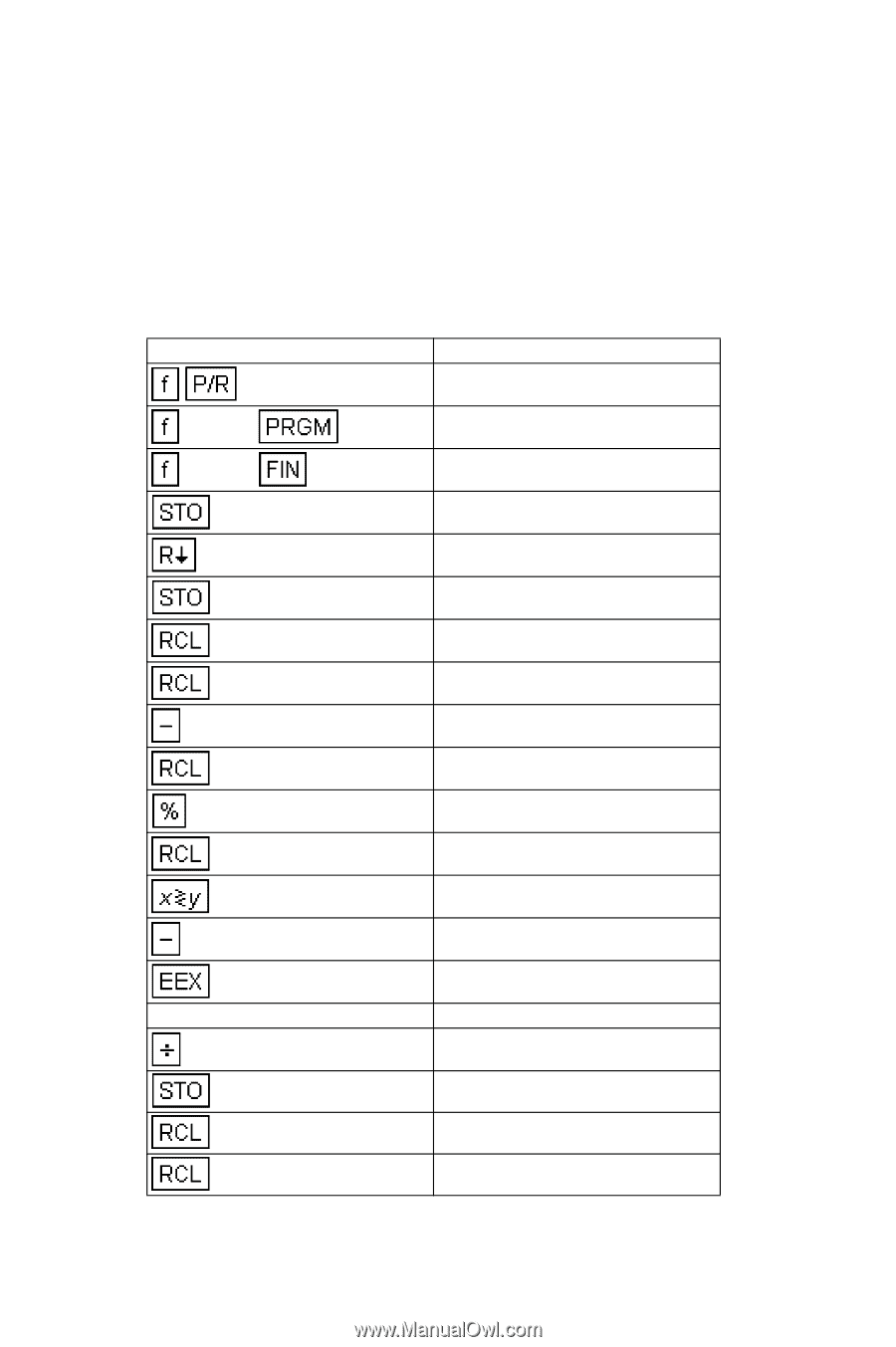

Securities After-Tax Yield The following HP-12C program calculate the after tax yield to maturity of a bond held for more than one year. The calculations assumes an actual/ actual day basis. For after-tax computations, the interest or coupon payments are considered income, while the difference between the bond or note face value and its purchase price is considered capital gains. KEYSTROKES DISPLAY CLEAR CLEAR 7 6 2 1 4 2 2 0 3 5 00- 01- 42 34 02- 44 7 03- 33 04- 44 6 05- 45 2 06- 45 1 07- 30 08- 45 4 09- 25 10- 45 2 11- 34 12- 30 13- 26 14- 2 15- 10 16- 44 0 17- 45 3 18- 45 5 65

65

Securities

After-Tax Yield

The following HP-12C program calculate the after tax yield to maturity of a

bond held for more than one year. The calculations assumes an actual/

actual day basis. For after-tax computations, the interest or coupon

payments are considered income, while the difference between the bond

or note face value and its purchase price is considered capital gains.

KEYSTROKES

DISPLAY

CLEAR

00-

CLEAR

01-

42 34

7

02-

44

7

03-

33

6

04-

44

6

2

05-

45

2

1

06-

45

1

07-

30

4

08-

45

4

09-

25

2

10-

45

2

11-

34

12-

30

13-

26

2

14-

2

15-

10

0

16-

44

0

3

17-

45

3

5

18-

45

5