Motorola 8167 User Manual - Page 31

Statements of Consolidated, Flews

|

View all Motorola 8167 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 31 highlights

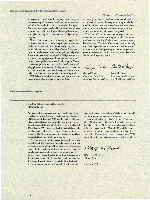

Statements of Consolidated Cash Flews Years ended December 31 (In millions) Operating Net earnings Add (deduct) non-cash items Depreciation Net change in deferred income taxes Amortization ofdebt discount Change in assets and liabilities, net of effects of acquisitions Accounts receivable, net Inventories Other current assets Accounts payable and accrued liabilities Other assets Other liabilities Net cash provided by operations Investing Businesses acquired and advances to affiliated companies Payments for property, plant and equipment Other changes to property, plant and equipment, net Increase in short-term investments Net cash used for investing activities :ing Increase (decrease) in notes payable and current portion of long-term debt Increase in long-term debt Issuance of common stock Payment of dividends to stockholders Net cash provided by financing activities Increase in Cash and Cash Equivalents See accompanying notes to consolidatedfinancialstatements. 1990 Motorola, Inc. and Consolidated Subsidiaries 1989 1988 $ 499 $ 498 445 790 650 543 (62) (31) (60) 26 (173) (72) (65) 186 28 151 1,308 (117) (1,256) 39 (110) (1,444) 208 7 55 (100) 170 * 34 (283) (29) (71) 306 95 76 1,211 (53) (1,094) (39) (57) (1,243) (251) 389 29 (99) 68 $ 36 (247) (223) 20 321 (49) (25) 725 (123) (873) (58) (42) (1,0%) 464 15 9 (83) 405 $ 34 29