Motorola 8167 User Manual - Page 4

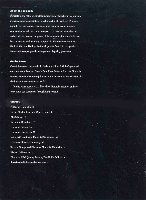

Financial Highlights

|

View all Motorola 8167 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 4 highlights

Financial Highlights Years ended December 31 (In millions, except as noted) Motorola, Inc. and Consolidated Subsidiaries 1990 1989 Net sales $10,885 Earnings before income taxes 666 % to sales 6.1% Net earnings 499 % to sales 4.6% Net earnings per share (in dollars) 3.80 Research and development expenditures Fixed asset expenditures1 1,008 1,260 Working capital 1,404 Current ratio 1.46 Return on average invested capital (stockholders' equity plus long- and short-term debt . less short-term investments)2 9.4% % of total debt less short-term investments to total debt less short-term investments plus equity2 Book value per common share (in dollars) Year-end employment (in thousands) ^Includes expenditures related to capitalized leases. 'Includes short-term investments categorized as cash and cash equivalents. 23.7% 32.32 105 $9,620 646 6.7% 498 5.2% 3.83 810 1,124 1,261 1.48 10.3% 23.7% 29.16 104