Sharp XEA102 XE-A102 Operation Manual in English and Spanish - Page 3

In Case of a Power Failure or - how do you void

|

UPC - 074000049093

View all Sharp XEA102 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 3 highlights

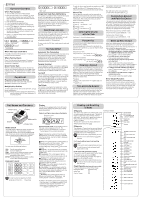

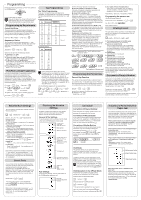

Programming Before you begin programming, turn the mode switch to the Z/PGM position. REG OFF X/Flash Z/PGM VOID Follow these steps as needed. D If you do not press the #/ SBTL key at the end of each programming step, you can continue program- ming without printing the programming report. Programming by Departments Preset Unit Price The preset unit price function assigns a frequently purchased item to a department key and enables you to enter the price simply by pressing the department key. Specify a price using the following sequence: Unit Price (Max. 5 digits) ➝ Dept. key (➝ ) #/ SBTL Department Status You can specify various status parameters (+/- sign, single item cash sale function, taxable status and entry digit limit) for a department key. Use the following sequence: ABCDEFG➝ @/TM ➝ Dept. key (➝ ) #/ SBTL where A to G represent the following choices. A: Choice of + or - sign Enter 0 for + or 1 for -. B: Choice of single item cash sale (SICS) function Enter 0 for normal or 1 for single item cash sale. C, D, E and F: Choice of taxable status Enter 0000 for non-taxable, 0001 for taxable 1, 0010 for taxable 2, 0100 for taxable 3, 1000 for taxable 4 or 0011 for taxable 1 and 2. G: Entry digit limit (0 to 7 digits) Enter 0, 1, 2, 3, 4, 5, 6 or 7 PLU (Price Look-Up) Programming Each PLU is associated to a department and the programmed contents for the department are automatically applied. Your cash register is preprogrammed so PLU codes 1-10 are assigned to department 1 and PLU codes 11-80 are disabled. To set the price or change the associated department, use the following sequence: P PLU code ➝ ➝ Price ➝ Dept. key (➝ ) #/ SBTL Ex.: 6 #/ 2 SBTL PLU code Price Associated dept. To disable a PLU code, use the following sequence: P v PLU code ➝ ➝ (➝ ) #/ SBTL Tax Programming Tax Table Programming If you are in an area that uses a tax table for tax calculation, you can program the cash register accordingly. Tax table programming can be performed for Tax 1 and Tax 2. Sample tax table 1 (6%): Tax Breakpoint Breakpoint difference .00 .01 .01 .11 .02 .23 .03 .39 .04 .57 .05 .73 .06 .89 .07 1.11 .08 1.23 .09 1.39 .10 1.57 .11 1.73 .12 1.89 .13 2.11 .10 Non-cyclic .12 .16 .18 Cyclic I .16 .16 .22 .12 .16 .18 .16 Cyclic II .16 .22 Sample tax table 2: Tax Breakpoint .00 .01 .01 .11 .02 .26 .03 .47 .04 .68 .06 .89 .09 1.11 .10 1.26 .11 1.47 .12 1.68 .14 1.89 .17 2.11 D If tax is not shown for every cent, use the breakpoint of the next highest tax amount for each missing breakpoint. In sample tax table 2, tax is not shown for .05, .07, .08, .13, .15 and .16. Likewise, the corresponding breakpoints are not shown. To complete the table, simply insert the next highest breakpoint after each missing figure. Therefore, the breakpoint for .05 would be .89, .07 and .08 would be 1.11, etc. Use the following sequence for tax programming: 8 ➝ ➝ #/ SBTL 1 for Tax 1 or 2 for Tax 2 ➝ @/TM ➝ R M Q ➝ @/TM ➝ ➝ @/TM ➝ ➝ @/TM ➝ Breakpoint ➝ where R, M and Q represent the following: R: Tax rate (0.0000% to 99.9999%) x 10000 If the rate is fractional, it should be converted to its decimal equivalent before entering. M: Cycle (0.01 to 99.99) x 100 In tax table 1, you can see that the breakpoint differences repeat in cycle. The value of M may be viewed as the taxable amount which is covered by a cycle. Thus, it can be determined by adding all of the breakpoint differences in a cycle or by simply taking the difference between the first breakpoint of the cycle and the first breakpoint of the next cycle. Q: Minimum taxable amount (0.01 to 99.99) x 100 This represents the smallest amount for which tax must be collected. In some states, sales whose amounts are less than a specific minimum taxable amount are not subject to taxation. Breakpoints (0.01 to 99.99) x 100 The tax amount increases in stages. The value of a taxable subtotal at which the tax amount changes is called a breakpoint. The difference between one breakpoint and the next is called the breakpoint difference. A group of breakpoint differences is repeated at regular intervals and each of these intervals is called a cycle. A maximum of 18 breakpoints (for tax types 1 and 2), between 0.01 to 99.99, can be programmed. Intervals between breakpoints must be less than one dollar. Example: Programmig Tax 1 as 6% sales tax using sample tax table 1. #/ SBTL @/TM Tax 1 0 0 0 0 @/TM Tax rate(R) 00 Cycle(M) @/TM @/TM Minimum taxable Breakpoint amount(Q) (First breakpoint) @/TM Breakpoint @/TM Breakpoint @/TM Breakpoint @/TM @/TM Breakpoint Breakpoint (First breakpoint of the next cycle) Programming the Percent key Percent Key Function The % key can be programmed as a discount key or as a premium key. The taxable status of the % key can also be programmed though it is pre-programmed as a non-taxable discount key. Use the following sequence: % ABCDE ➝ @/TM ➝ (➝ ) #/ SBTL where A to E represent the following choices A: Choice of + or - sign Enter 0 for + or 1 for - . B, C, D and E: Choice of taxable status Enter 0000 for non-taxable, 0001 for taxable 1, 0010 for taxable 2, 0100 for taxable 3, 1000 for taxable 4 or 0011 for taxable 1 and 2. Initial setting: - (discount), non-taxable ("10000") Programming the percent rate Use the following sequence: % Percent rate (0.01% to 99.99%) ➝ (➝ ) #/ SBTL (ex. For 10.00% enter 1 0 0 0 .) Initial setting: 0.00(%) Printing Format You can choose either a journal or receipt format and specify other options for the printing format. Use the following sequence: 2 ➝ #/ SBTL ➝ ABCDEFG ➝ #/ SBTL (➝ ) #/ SBTL A: Printing journal/receipt in the REG mode Enter 0 for printing or 1 for no printing. B: Journal or receipt format Enter 0 for journal format or 1 for receipt format. (In the receipt format, the paper is fed by a few lines upon finalization of each transaction. In the journal format, the paper is wound around the take- up spool.) C: Printing date Enter 0 to print or 1 not to print D: Printing time Enter 0 to print or 1 not to print E: Printing consecutive numbers Enter 0 to print or 1 not to print F: Printing taxable subtotal Enter 0 to print or 1 not to print G: Printing merchandise subtotal with #/ SBTL Enter 0 to print or 1 not to print Initial setting: printing in the REG mode, journal format, printing date, time and consecutive number, and not printing taxable subtotal and merchandise subtotal ("0000011") Consecutive Receipt Number Consecutive receipt number can be printed on every transaction or receipt and report with the date and time. Use the following sequence to set the receipt start number. To start from a specific number, enter the number less one (e.g. if you want to start from receipt number 1001, enter 1000). Consecutive (receipt) number ➝ @/TM ➝ #/ SBTL (➝ ) #/ SBTL Initial setting: starting from 0001("0000") (For miscellaneous settings, secret code and checking machine settings, see the columns below. ) Miscellaneous Settings You can program miscellaneous settings using the following sequence: 1 ➝ #/ SBTL ➝ ABCDEFGH ➝ #/ SBTL (➝ ) #/ SBTL where A, B, C, D, E, F, G and H represent the following choices. A: Date format Enter 0 for mmddyy, 1 for ddmmyy or 2 for yymmdd. B: Time format Enter 0 for 12 hour system or 1 for 24 hour system. C: Decimal point setting Enter 0, 1, 2 or 3 for the decimal point position. D: Resetting receipt no. when issuing Z report Enter 0 to not reset or 1 to reset E: Amount tendered compulsory Enter 0 for non compulsory or 1 for compulsory. F: Choice of #/ SBTL compulsory Enter 0 for non compulsory or 1 for compulsory. g, k, , G: Entry digit limit for TAX1 SHIFT /RA and TAX2 SHIFT /PO manual tax Enter 0, 1, 2, 3, 4, 5, 6, 7 or 8 for the entry digit limit. H: Rounding Enter 0 for rounding off, 1 for rounding up or 2 for rounding down Initial setting: date format "mmddyy", time format "12 hour system", decimal point position "2", not resetting, amount tendered non compulsory, s non compulsory, entry digit limit "8" and rounding off ("00200080") Secret Code A secret code can be specified so that only those who know the secret code may issue Z reports for reading and resetting of sales, perform programming in the Z/PGM mode and void operation in the VOID mode. The pre-programmed secret code setting is 0000 (no secret code). Use the following sequence to enter a secret code (4 digits). Secret code ➝ @/TM ➝ The secret code function can be disabled by entering 0 0 0 0 (or nothing) for the code in the above sequence. When entry of secret code is necessary, "----" is displayed. Each time you enter a number for the secret code, the corresponding symbol "-" changes to "_". Checking the Machine Settings To obtain a printout that shows the cash register settings, turn the mode switch to the Z/PGM position and use the following sequence: General & Tax Settings To see the general and tax settings, turn the mode switch to the Z/PGM position and press . #/ SBTL Taxable status Dept. code Sign and unit price Entry digit limit SICS (1) / Normal (0) Taxable status for % Sign and rate for % Secret code Miscellaneous settings Printing format Tax table(Tax1) Percentage tax rate(Tax2) Minimum taxable amount Clerk code Date Time Receipt number PLU Settings To see the PLU settings, turn the mode switch to the Z/PGM position and press P. PLU code Associated department Unit price Correction Correction of Entered Number When you enter an incorrect number, delete it by pressing CL immediately after the entry. Correction of the Last Entry If you make a mistake when making a department entry, PLU entry, repetitive or multiplication entry, discount or premium entry by % , or manual tax entry, you can correct this by pressing v. Correction of Earlier Entries You can correct any incorrect entry made during a transaction if you find it before finalizing the transaction by pressing , g, k, etc. For example, to correct 3 P entry to 4 P after another correct entry has been made, enter the following: P 3 1 1 5 01 4 P 5 3 vP Void Mode This function allows you to reverse the entries made in an incorrect receipt. The entries are subtracted from each totalizer and added to a void totalizer. To use this function, turn the mode switch to the VOID position and enter the same details that are on the incorrect receipt. The VOID mode symbol(VD) is printed at the bottom of the receipt. D If the secret code is programmed, you have to enter the secret code and press after setting the mode switch to the VOID position. Void Operation in the X/Flash Mode Received-on-account(RA) and paid-out(PO) entries can be corrected in the X/Flash mode. Void operation for RA(X/Flash mode) ➝ ➝ VOID * amount TAX1 SHIFT /RA Void operation for PO(X/Flash mode) ➝ ➝ VOID * amount TAX2 SHIFT /PO *If the secret code is programmed, you have to enter the secret code here and press VOID again before entering the amount and pressing TAX1 SHIFT /RA or . TAX2 SHIFT /PO In Case of a Power Failure or Paper Jam The following situations may arise during a power failure or paper jam. (Make sure that batteries are correctly installed.) As the power is recovered or a paper jam is removed, the register will resume normal operation with a next key operation. When a power failure occurs with the register turned on or during a computation process: Upon power recovery, the register resumes operation from the point of failure. When a power failure occurs during printing of transaction data: Upon power recovery, the register prints and resumes printing of the transaction data. When a power failure occurs during printing of an X (reading) or Z (reading and resetting) report: Upon power recovery, the register prints and resumes printing of the report. Before power failure Power failure mark After power failure When the printer motor is locked due to a paper jam: Printing stops and intermittent beeping starts. First, unplug the power cord and clear the paper jam. Then plug in the power cord, feed the roll paper to the proper position and press CL . The register will then resume printing after printing