HP HP12C hp 12c_user's guide_English_E_HDPMBF12E44.pdf - Page 53

Divides by the length of a monthly

|

UPC - 882780792104

View all HP HP12C manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 53 highlights

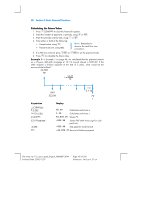

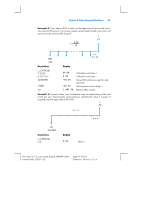

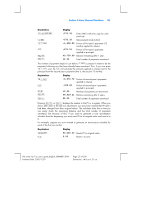

Section 3: Basic Financial Functions 53 Example 2: A 42-month car loan for $3,950 began accruing interest on July 19, 2004, so that the first period began on August 1, 2004. Payments of $120 are made at the end of each month. Calculate the annual percentage rate (APR), using the actual number of odd days and simple interest for the odd period. Keystrokes Display fCLEARG ?Æ 7.192004\ 8.012004 gÒ 30z 42+n 3950$ 7.19 8.012004 13.00 0.43 42.43 3,950.00 Clears financial registers. Turns off the C indicator in the display, so that simple interest will be used for the odd period. Keys in the date interest begins accruing and separates it from the next date entered. Keys in the date of the beginning of the first period. Actual number of odd days. Divides by the length of a monthly period to get the fractional part of n. Adds the fractional part of n to the number of complete payment periods, then stores the result in n. Stores PV. 120ÞP ¼ 12§ -120.00 1.16 13.95 Stores PMT (with minus sign for cash paid out). Periodic (monthly) interest rate. Annual percentage rate (APR). File name: hp 12c_user's guide_English_HDPMBF12E44 Printered Date: 2005/7/29 Page: 53 of 209 Dimension: 14.8 cm x 21 cm