Motorola 8167 User Manual - Page 32

Foreign Currency Translation: The Company uses the U.S.

|

View all Motorola 8167 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 32 highlights

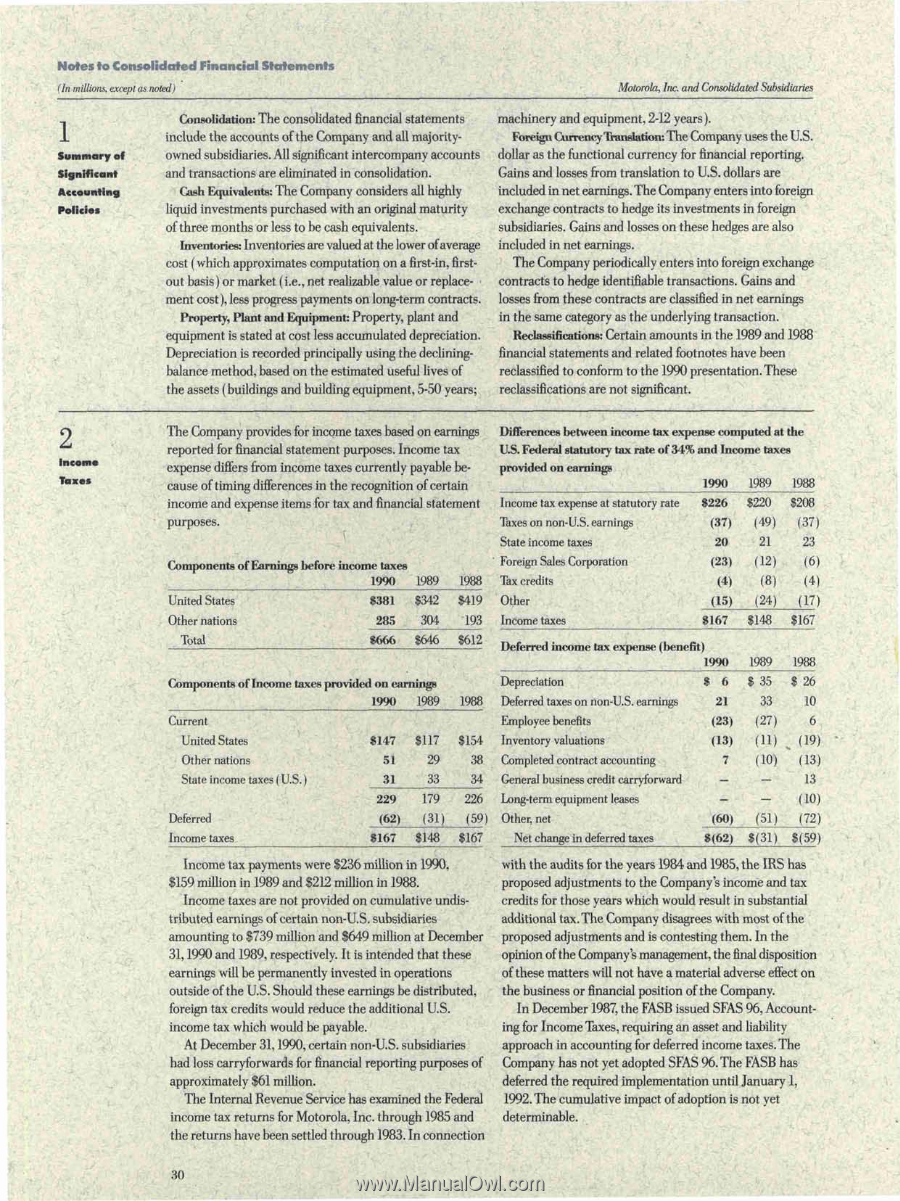

Notes to Consolidated Financial Statements (In millions, except as noted) Motorola, Inc. and Consolidated Subsidiaries 1 Summary of Significant Accounting Policies Consolidation: The consolidated financial statements include the accounts of the Company and all majorityowned subsidiaries. All significant intercompany accounts and transactions are eliminated in consolidation. Cash Equivalents: The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. Inventories: Inventories are valued at the lower ofaverage cost (which approximates computation on afirst-in,firstout basis) or market (i.e., net realizable value or replacement cost), less progress payments on long-term contracts. Property, Plant and Equipment: Property, plant and equipment is stated at cost less accumulated depreciation. Depreciation is recorded principally using the decliningbalance method, based on the estimated useful lives of the assets (buildings and building equipment, 5-50 years; machinery and equipment, 2-12 years). Foreign CurrencyTranslation: The Company uses the U.S. dollar as the functional currency for financial reporting. Gains and losses from translation to U.S. dollars are included in net earnings. The Company enters into foreign exchange contracts to hedge its investments in foreign subsidiaries. Gains and losses on these hedges are also included in net earnings. The Company periodically enters into foreign exchange contracts to hedge identifiable transactions. Gains and losses from these contracts are classified in net earnings in the same category as the underlying transaction. Reclassifications: Certain amounts in the 1989 and 1988 financial statements and related footnotes have been reclassified to conform to the 1990 presentation. These reclassifications are not significant. lax** The Company provides for income taxes based on earnings Differences between income tax expense computed at the reported for financial statement purposes. Income tax U.S. Federal statutory tax rate of 34% and Income taxes expense differs from income taxes currently payable be- provided on earnings cause of timing differences in the recognition of certain income and expense items for tax and financial statement purposes. Income tax expense at statutory rate Taxes on non-U.S. earnings 1990 $226 (37) 1989 $220 (49) 1988 (37) State income taxes 20 21 23 Components of Earnings before income taxes Foreign Sales Corporation 1990 1989 1988 Tax credits (23) (12) (6) (4) (8) (4) United States 8381 $342 $419 Other (15) (24) (17) Other nations 285 304 193 Income taxes 8167 $148 $167 Total S666 $646 $612 Deferred income tax expense (benefit) 1990 1989 1988 Components of Income taxes provided on earnings Depreciation $ 6 $ 35 $ 26 1990 1989 1988 Deferred taxes on non-U.S. earnings 21 33 10 Current Employee benefits (23) (27) 6 United States $147 $117 $154 Inventory valuations (13) (11) __ (19) Other nations 51 29 38 Completed contract accounting 7 (10) (13) State income taxes (U.S.) 31 33 34 General business credit carryforward - - 13 229 179 226 Long-term equipment leases - - (10) Deferred (62) (31) (59) Other, net (60) (51) (72) Income taxes $167 $148 $167 Net change in deferred taxes 8(62) $(31) $(59) Income tax payments were $236 million in 1990, $159 million in 1989 and $212 million in 1988. Income taxes are not provided on cumulative undistributed earnings of certain non-U.S. subsidiaries amounting to $739 million and $649 million at December 31,1990 and 1989, respectively. It is intended that these earnings will be permanently invested in operations outside of the U.S. Should these earnings be distributed, foreign tax credits would reduce the additional U.S. income tax which would be payable. At December 31,1990, certain non-U.S. subsidiaries had loss carryforwards for financial reporting purposes of approximately $61 million. The Internal Revenue Service has examined the Federal income tax returns for Motorola, Inc. through 1985 and the returns have been settled through 1983. In connection with the audits for the years 1984 and 1985, the IRS has proposed adjustments to the Company's income and tax credits for those years which would result in substantial additional tax. The Company disagrees with most of the proposed adjustments and is contesting them. In the opinion of the Company's management, thefinaldisposition of these matters will not have a material adverse effect on the business or financial position of the Company. In December 1987, the FASB issued SFAS 96, Accounting for Income Taxes, requiring an asset and liability approach in accounting for deferred income taxes. The Company has not yet adopted SFAS 96. The FASB has deferred the required implementation until January 1, 1992. The cumulative impact of adoption is not yet determinable. 30