Motorola 8167 User Manual - Page 33

Yield Option™ Notes

|

View all Motorola 8167 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 33 highlights

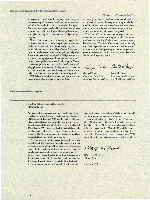

(In millions, except as noted) 3 Debt and Cradit Facilities December 31 Long-term debt 12% eurodollar notes due 1994 IP/2% eurodollar notes due 1997 8%% ECU notes due 1992 8% sinking fund debentures due 2007 (callable at 103.7% reducing to 100.0% of the principal amount) 6.15% industrial revenue bonds due 2014 Zero coupon notes due 2009 Capitalized lease obligations Other long-term debt Less current maturities Long-term debt 1990 8 68 93 69 62 20 438 38 23 811 19 8 792 Short-term debt Commercial paper Notes to banks Other short-term debt Add current maturities Notes payable and current portion of long-term debt 1990 8 733 224 19 976 19 8 995 Motorola, Inc. and Consolidated Subsidiaries 1989 $ 68 93 60 62 15 413 45 16 772 17 $755 1989 $507 244 19 770 17 $787 The zero coupon notes due 2009, referred to as Liquid Yield Option™ Notes (LYON™), have a face value of $1.32 billion. The LYONs are subordinated notes, have no periodic interest payments, are convertible into 4.567 shares of Motorola common stock and were priced to yield 6% to maturity. The notes may be redeemed by the holders in specified circumstances prior to the stated maturity date. Aggregate maturities and sinking fund requirements for long-term debt, in millions, during the next five years are as follows: 1991,119; 1992, $88; 1993, $7; 1994, $69; 1995, $9. The industrial revenue bonds have an interest rate which is resettable annually or for the remaining life of the bonds. The rate changed from 6.15% to 5.75% on January 1, 1991 for 1991. The Company has domestic and international credit facilities for short-term borrowings, generally with banks. It pays commitment fees of approximately 1/10% on its domestic credit facilities and generally no fees on its foreign credit facilities. Short-term credit facilities totalled $1.78 billion at December 31,1990, of which $788 million remain unused. Domestic credit facilities primarily back up the issuance of commercial paper, while foreign credit facilities generally support working capital requirements. Outstanding letters of credit aggregated approximately $116 million at December 31,1990. "T Property, Plant and tquipmant December 31 Land Buildings Machinery Equipment leased to others Less accumulated depreciation Property, plant and equipment, net 1990 8 116 1,771 4,257 415 6,559 2,781 83,778 1989 $ 107 1,575 3,715 356 5,753 2,416 $3,337 The Company owns most of its major facilities, but does lease certain office, factory and warehouse space, land, data processing and other equipment under principally noncancellable operating leases. In addition, equipment is leased to others under noncancellable operating leases. Rental expense, net of sublease income, was $132 million in 1990, $125 million in 1989 and $121 million in 1988. Capital lease expenditures were $4 million in 1990, $30 million in 1989 and $26 million in 1988. At December 31,1990, future minimum lease revenues under noncancellable leases and lease obligations, net of minimum sublease rentals, were as follows: Lease Lease Revenues Obligations 1991 1992 1993 1994 1995 Beyond $66 $124 38 101 19 61 8 36 3 22 1 63 31