Sharp EL-738 EL-738 Operation Manual - Page 37

Calculating payments, interest, and loan bal, ance after a specified payment

|

UPC - 074000018518

View all Sharp EL-738 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 37 highlights

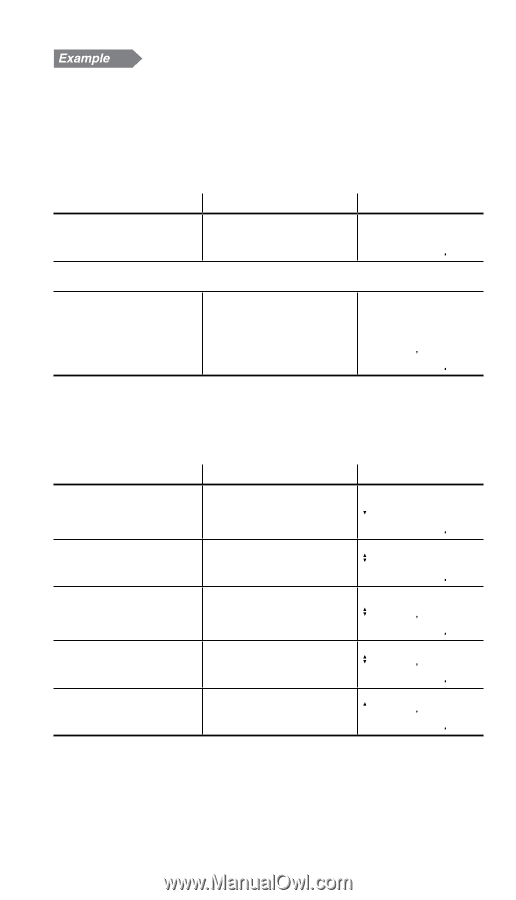

2 Calculating payments, interest, and loan balance after a specified payment You have taken out a 30-year loan for $500,000, with an annual interest rate of 8.5%. If, after the 48th period, you want a balloon payment due, what amount of monthly payment must you make with monthly compounding and how much will the balloon payment be? Procedure Set all the variables to default values. Key operation s . b Display 000 Make sure ordinary annuity is set (BGN is not displayed). Set TVM solver variables and calculate payment. . w 12 Q s 30 . < N 500000 v 0 T 8.5 f @ u PMT= -384457 Answer: The monthly payment is $3,844.57. Now generate an amortization schedule from the first to the 48th payments. Procedure Key operation Display Change to amortization * 1 Q calculation and enter 1 for the starting payment. AMRT P1= 100 Enter 48 (December) i 48 Q for the ending payment. AMRT P2= 4800 Display the balance af- i ter 48 months. (balloon payment) BALANCE= 48275524 Display the principal i paid over 48 months. ÍPRINCIPAL= -1724476 Display the interest i paid over 48 months. ÍINTEREST= -16729460 Answer: The balloon payment after the 48th period would be $482,755.24. 36