Sharp EL-738 EL-738 Operation Manual - Page 41

Variables used in discounted cash flow analysis, NPV and IRR, Basic operations - calculate irr

|

UPC - 074000018518

View all Sharp EL-738 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 41 highlights

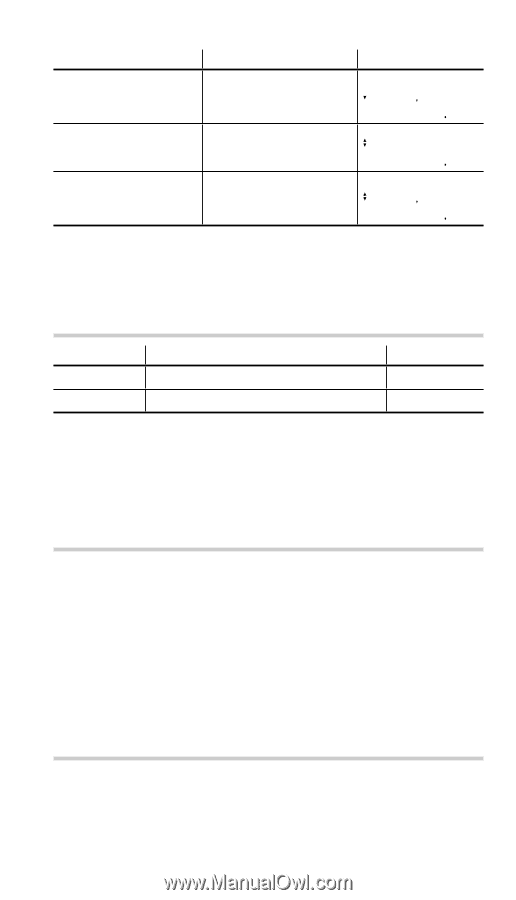

Procedure Key operation Display Change the first cash , 30000 J flow value from -25,000 to -30,000. CF D-= -3000000 Change the frequency i i i i CF N3= of 5000 from 2 to 1. i i i 1 J 100 Add a new data set (6000) immediately before 5000. . e 6000 J CF D3= 600000 To confirm the corrections, press . z to jump to the first data item and press i to browse through each data item. Variables used in discounted cash flow analysis Variable RATE (I/Y) NET_PV Description Internal rate of return (IRR) Net present value (NPV) Default value 0 - • The variable RATE (I/Y) is shared by the variable I/Y. NET_PV is for calculation only and has no default value. • The BGN/END setting is not available for discounted cash flow analysis. NPV and IRR The calculator solves the following cash flow values: Net present value (NPV): The total present value of all cash flows, including cash paid out (outflows) and cash received (inflows). A profitable investment is indicated by a positive NPV value. Internal rate of return (IRR): The interest rate that gives a net present value of zero. Basic operations Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. 40