Sharp ER-A440 Instruction Manual - Page 28

Tax rate, Programming the tax rate - error

|

View all Sharp ER-A440 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 28 highlights

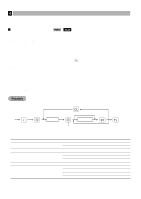

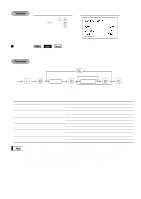

8 Programming the tax rate Tax rate PGM 2 Procedure ◊ *A ≈ 1-6 **Sign and tax rate To program zero ≈ Lowest taxable amount max. five digits: 0.00 to 999.99 ; * A: Enter a corresponding tax rate number. For example, when you program a tax rate as tax rate 1, enter "1", and when you program it as tax rate 6, enter "6". ** Sign and tax rate: XYYY.YYYY Tax rate= 0.0001 to 100.0000 Sign -/+ = 1/0 Note • The lowest taxable amount is valid only when you select add on tax system. If you select VAT (Value added tax) system, it is ignored. ≈ • If you make an incorrect entry before pressing the second key in programming a tax rate, c ≈ cancel it with the key; and if you make an error after pressing the second key, cancel it : with the key. Then program again from the beginning. • If you select VAT system, the sign which you program is ignored. Example Programming the tax rate (+4%) as tax rate 2 with lowest taxable income as 0.12. 1. Press the ◊ key. 2. Enter the tax rate "2". 3. Enter the tax rate "+4%." 4. Enter the lowest taxable amount "12." ; 5. Press the key to finalize the programming and generate a programming report. ◊ 2 ≈ 4 ≈ 12 ; Print P 0.00 P 0.00 P 0.00 P 12 0.00 Tax rate 2 Tax rate : 4% Lowest taxable amount 26