Casio 140CR User Manual - Page 26

Part-2, Convenient Operation

|

UPC - 079767507626

View all Casio 140CR manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 26 highlights

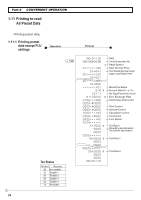

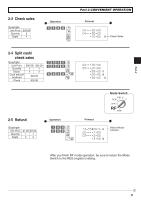

Part-2 CONVENIENT OPERATION 1-9 Setting the Tax Rate C k and rounding P3 appears in mode display ?ZXB k Program set code No. for tax rate 1*1 ??"???? p Enter tax rate A ???? p Select numbers from list B Select number from list D Select number from list C k *1 Program set code No. for Tax rate 2 is ?XXB Tax rate 3 is ?CXB Tax rate 4 is ?VXB. • You can use either an add-on rate tax or an add-in rate tax (VAT), depending on the requirements in your area. You can specify only one tax rate. • The normal rounding specification tells the cash register how to round tax amounts to the proper number of decimal places. • The special rounding specification and Danish rounding tell the cash register how to round off subtotals and totals so that their rightmost 2 digits are 00 and 50. • Note that the rounding specification you program for your cash register depends on the tax laws of your country. (To end the setting) Tax rate specifications The tax rate within the range of 0.0001 ~ 99.9999%. Use " key for decimal point. A Normal rounding specifications Cut off to 2 decimal places. (1.544=1.54; 1.545=1.54) ?? Round off to 2 decimal places. (1.544=1.54; 1.545=1.55) B? B Round up to 2 decimal places. (1.544=1.55; 1.545=1.55) >? Special rounding specifications for subtotal and total amounts No specifications Special rounding 1: 0 ~ 2 ➝ 0; 3 ~ 7 ➝ 5; 8 ~ 9 ➝ 10 Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30 Special rounding 2: 0 ~ 4 ➝ 0; 5 ~ 9 ➝ 10 Examples: 1.123=1.120; 1.525=1.530 Danish rounding *1: 0 ~ 24 ➝ 0; 25 ~74 ➝ 50; 75 ~ 100 ➝ 100 (set the amount tender restriction on page 22 also) Examples: 1.11=1.00; 1.39=1.50;1.99=2.00 Malaysian rounding: 0 ~ 2 ➝ 0; 3 ~ 7 ➝ 5; 8 ~ 9 ➝ 10 (set the amount tender restriction on page 22 also) Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30 Scandinavian rounding: 0~ 24 ➝ 0; 25 ~ 74 ➝ 50; 75 ~ 99 ➝ 100 Examples: 1.21=1.0; 1.30=1.50; 1.87=2.00 Australian rounding (only for tax rate 1) 0 ~ 2 ➝ 0; 3 ~ 7 ➝ 5; 8 ~ 9 ➝ 10 Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30 Czech rounding: 0 ~ 49 ➝ 00; 50 ~ 99 ➝ 100 Examples: 1.23=1.00; 1.52=2.00 ? Z X C BC N M < Normal rounding specifications No specifications. ? Specifies add-on rate tax. XD Specifies add-in rate tax (VAT). C See page 19 (department key), 20 (percent key), 21 (minus key) to change the fixed tax status. *1: In case of defining Danish rounding, the Euro should be set to the sub currency and the local to the main currency. E 26