HP 30b HP 20b Business Consultant and HP 30b Business Professional User's Guid - Page 46

Cash Flow Example, you expect returns over the next five years

|

View all HP 30b manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 46 highlights

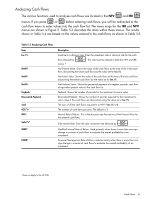

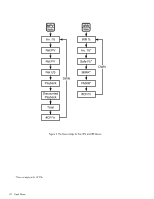

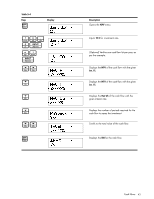

:x To erase a cash flow list, with any cash flow displayed press . The number of cash flows in the list is displayed on the bottom line, along with Cash Flow=. At this prompt, press I I . You will be asked to confirm your choice. Either press to confirm the O reset, or to cancel. Table 5-1 lists the keys used for cash flow problems. For a cash flow example, see Table 5-2. Table 5-1 Cash Flow Keys Key C I >< o j RP Description Opens the cash flow list. Inputs new values for variables in the cash flow list, the Net Present Value (NPV) menu, and the Internal Rate of Return (IRR) menu. Scrolls up and down. Inserts cash flows into a cash flow list. Removes cash flows from a cash flow list. Opens the Internal Rate of Return (IRR) and Net Present Value (NPV) menus. Cash Flow Example After an initial investment of 80,000.00, CF (0), you expect returns over the next five years as follows: Cash Flow Number 1 2 3 4 5 6 Cash Flow Amount 5,000.00 4,500.00 0.00 4,000.00 5,000.00 115,000.00 Occurrences 1 1 1 1 5 1 Given this information, calculate the total of the cash flows and the internal rate of return (IRR) of the investment. Calculate net present value (NPV) and net future value (NFV), assuming an annual investment interest rate of 10.5%. See Figure 1 for the cash flow diagram and Table 5-2 for how to enter the cash flows. The example is calculated with RPN as the active operating mode. 38 Cash Flows