Sharp EL-733 EL-733A Operation Manual - Page 42

Sharp EL-733 Manual

|

View all Sharp EL-733 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 42 highlights

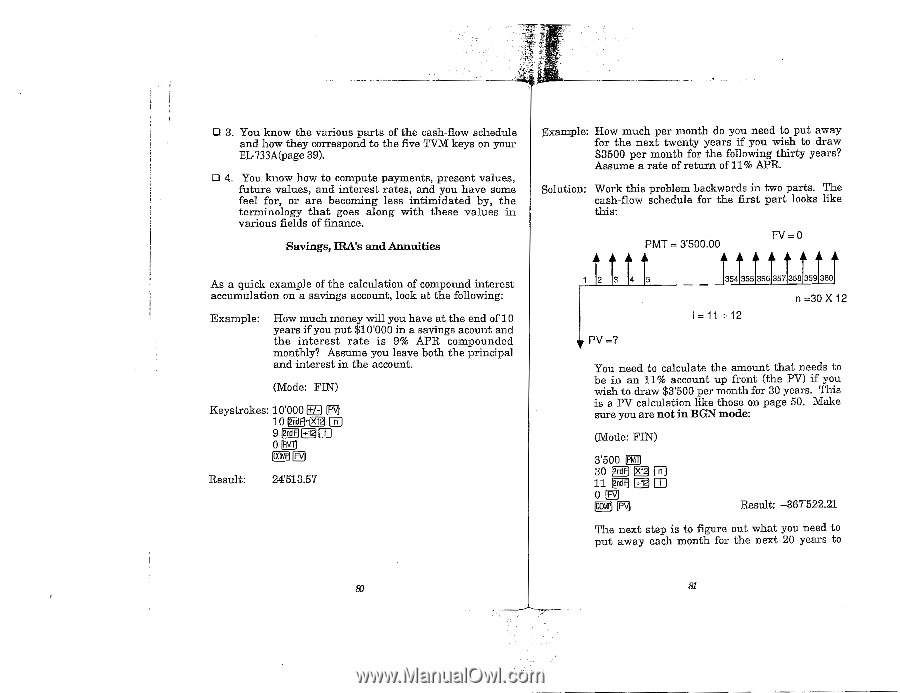

u 3. You know the various parts of the cash-flow schedule and how they correspond to the five TVM keys on your EL-733A(Page 39). O 4. You know how to compute payments, present values, future values, and interest rates, and you have some feel for, or are becoming less intimidated by, the terminology that goes along with these values in various fields of finance. Savings, IRA's and Annuities Example: How much per month do you need to put away for the next twenty years if you wish to draw $3500 per month for the following thirty years? Assume a rate of return of 11% APR. Solution: Work this problem backwards in two parts. The cash-flow schedule for the first part looks like this: PMT = 3'500.00 FV = 0 As a quick example of the calculation of compound interest accumulation on a savings account, look at the following: Example: How much money will you have at the end of 10 years if you put $10'000 in a savings acount and the interest rate is 9% APR compounded monthly? Assume you leave both the principal and interest in the account. (Mode: FIN) Keystrokes: 1010001+/-1 Pv 10 I2ndF11- 2 E) 9 [2ndf)[÷121M 0 IfIkAl) [cowl Result: 24'513.57 1 tttt PV =? 1354t35:3513515:35 94136: i=11+12 n=30 X 12 You need to calculate the amount that needs to be in an 11% account up front (the PV) if you wish to draw $3'500 per month for 30 years. This is a PV calculation like those on page 50. Make sure you are not in BGN mode: (Mode: FIN) 3'500 M 30 FAR x1) NJ 11 [2ndF] M PmPI PV Result: -367522.21 The next step is to figure out what you need to put away each month for the next 20 years to 81