Sharp EL-733 EL-733A Operation Manual - Page 68

mentioning - el 733a calculator manual

|

View all Sharp EL-733 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 68 highlights

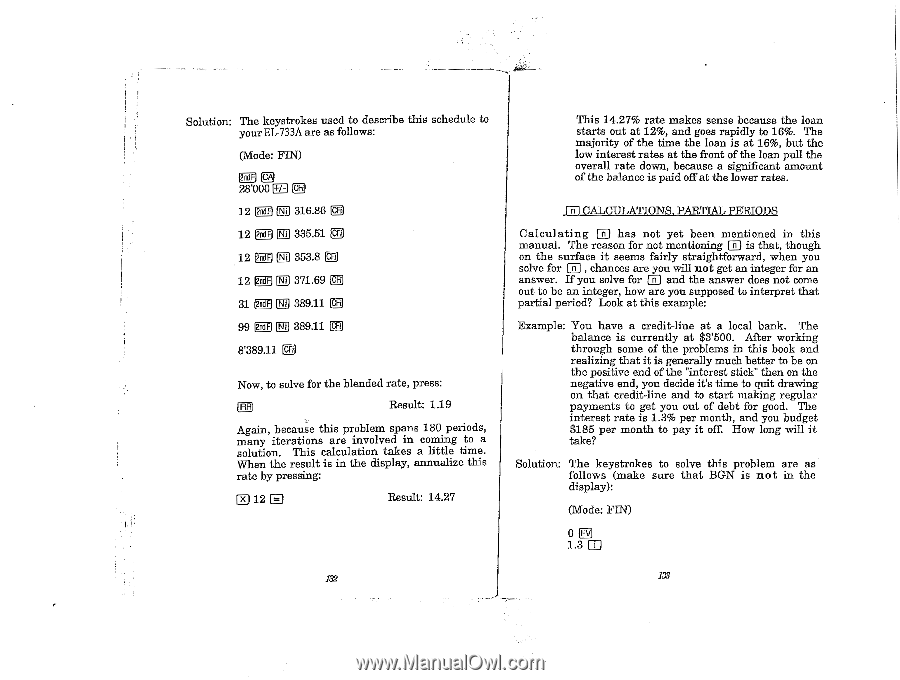

Solution: The keystrokes used to describe this schedule to your EL-733A are as follows: (Mode: FIN) 2ndn 28'000 It/ 12 2nd Ni 316.86 12 [2ndF) Ni 335.51 12 VW) Ni 353.8 lb 12 2ndF Ni 371.69 31 2nd Ni 389.11 99 2rdF) Ni 389.11 El 8'389.11 Now, to solve for the blended rate, press: Result: 1.19 Again, because this problem spans 180 periods, many iterations are involved in coming to a solution. This calculation takes a little time. When the result is in the display, annualize this rate by pressing: 0 12 Result: 14.27 732 This 14.27% rate makes sense because the loan starts out at 12%, and goes rapidly to 16%. The majority of the time the loan is at 16%, but the low interest rates at the front of the loan pull the overall rate down, because a significant amount of the balance is paid off at the lower rates. CALCULATIONS, PARTIAL PERIODS Calculating E) has not yet been mentioned in this manual. The reason for not mentioning E) is that, though on the surface it seems fairly straightforward, when you solve for n chances are you will not get an integer for an answer. If you solve for 0 and the answer does not come out to be an integer, how are you supposed to interpret that partial period? Look at this example: Example: You have a credit-line at a local bank. The balance is currently at $31500. After working through some of the problems in this book and realizing that it is generally much better to be on the positive end of the "interest stick" then on the negative end, you decide it's time to quit drawing on that credit-line and to start making regular payments to get you out of debt for good. The interest rate is 1.3% per month, and you budget $185 per month to pay it off. How long will it take? Solution: The keystrokes to solve this problem are as follows (make sure that BGN is not in the display): (Mode: FIN) 0 El 1.3 El .733