Sharp EL-733 EL-733A Operation Manual - Page 47

I.12I

|

View all Sharp EL-733 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 47 highlights

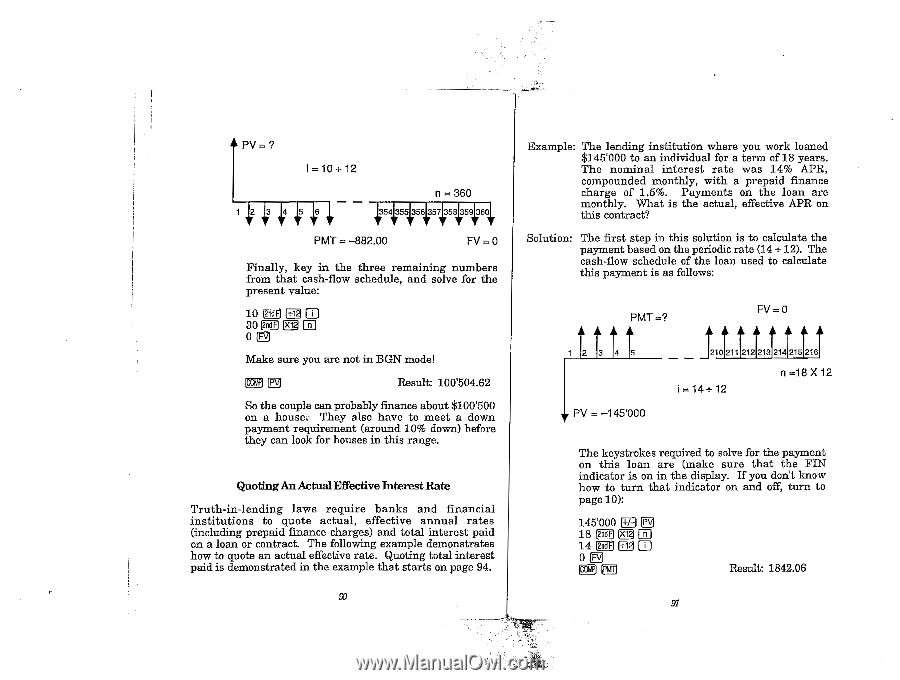

PV = ? i=10÷12 I 'I' n = 360 11,5$551,9561,57,frst5to lk PMT= -882.00 FV = 0 Finally, key in the three remaining numbers from that cash-flow schedule, and solve for the present value: 10 2nd I.12I El 30 Ficil 0 EI Make sure you are not in BGN mode! ji g Result: 100'504.62 So the couple can probably finance about $1001500 on a house.: They also have to meet a down payment requirement (around 10% down) before they can look for houses in this range. QuotingAn Actual Effective Interest Rate Truth-in-lending laws require banks and financial institutions to quote actual, effective annual rates (including prepaid finance charges) and total interest paid on a loan or contract. The following example demonstrates how to quote an actual effective rate. Quoting total interest paid is demonstrated in the example that starts on page 94. Example: The lending institution where you work loaned $145'000 to an individual for a term of 18 years. The nominal interest rate was 14% APR, compounded monthly, with a prepaid finance charge of 1.5%. Payments on the loan are monthly. What is the actual, effective APR on this contract? Solution: The first step in this solution is to calculate the payment based on the periodic rate (14 +12). The cash-flow schedule of the loan used to calculate this payment is as follows: PMT FV= 0 It t tt PV = -145'000 1210121:2112121:2151216. 1 I= 14 12 n =18 X 12 The keystrokes required to solve for the payment on this loan are (make sure that the FIN indicator is on in the display. If you don't know how to turn that indicator on and off, turn to page 10): 145'000 [+/-I 0 18 12nd9I [X121 14 I2nd9 H121 LU 0 E M Result: 1842.06 91