Sony PEG-NZ90 powerOne Personal v2.0 Operating Instructions - Page 26

Profit Margin, Sales Tax, Change, Periods, Price, Margin, Before Tax, Tax Rate

|

View all Sony PEG-NZ90 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 26 highlights

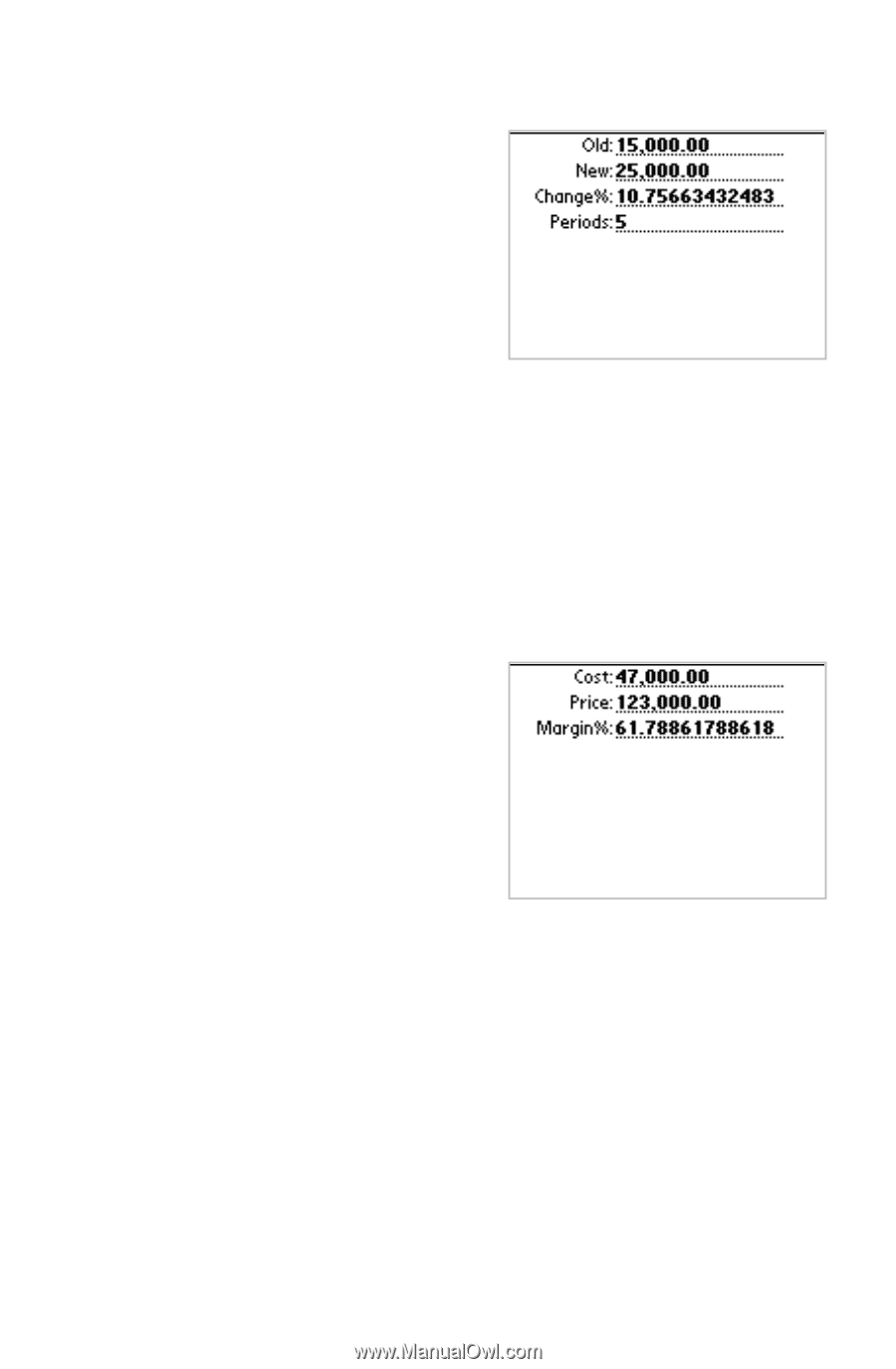

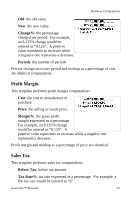

Business Computations • Old: the old value. • New: the new value. • Change%: the percentage changed per period. For example, an 8.125% change would be entered as "8.125". A positive value represents an increase while a negative one represents a decrease. • Periods: the number of periods. Percent change set to one period and markup as a percentage of cost are identical computations. Profit Margin This template performs profit margin computations: • Cost: the cost to manufacture or purchase. • Price: the selling or resale price. • Margin%: the gross profit margin expressed as a percentage. For example, an 8.125% change would be entered as "8.125". A positive value represents an increase while a negative one represents a decrease. Profit margin and markup as a percentage of price are identical. Sales Tax This template performs sales tax computations: • Before Tax: before tax amount. • Tax Rate%: tax rate expressed as a percentage. For example, a 6% tax rate would be entered as "6". powerOne™ Personal 23