Sharp ER-A320 Programmer Manual - Page 7

JOB#916] MRS = 0000, JOB#917] MRS = 0000, JOB#918] MRS = 2000 - sale

|

UPC - 074927900194

View all Sharp ER-A320 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 7 highlights

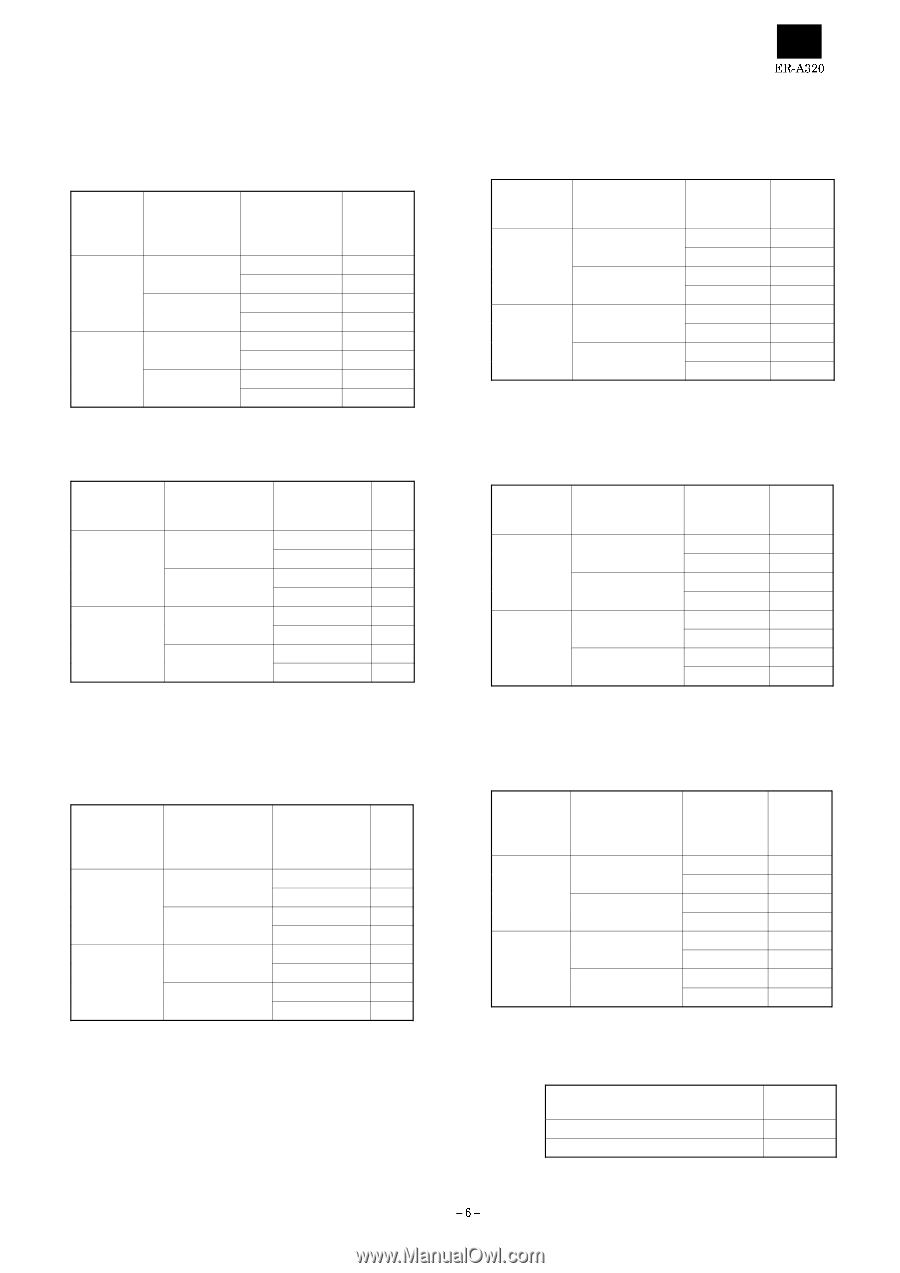

[JOB#916] MRS = 0000 #916-A, B: Not used (Fixed at "00") #916-C : 1. Negative merchandise subtotal 2. Subtotal entry compulsory before tendering 3. Subtotal entry before direct non-tendering finalization 1. Negative merchandise subtotal 2. Subtotal entry compulsory before tendering 3. Subtotal entry before direct non-tendering finalization 916-C Non-compulsory 0 5 Non-compulsory Allow Compulsory 1 Non-compulsory 2 Compulsory Compulsory 3 Non-compulsory 4 Non-compulsory Disallow compulsory 5 Compulsory Non-compulsory 6 Compulsory 7 #916-D : 1. Coupon PLU printing on X/Z report 2. Net sales subtotaI (NET1) printing on X/Z report 3. CHECK change total printing on X/Z report 1. Print coupon 2. Print net sales 3. Print CHK PLU's on SBTL (NET1) on CHANGE on 916-D general report general report general report Print Print Skip Print Skip Print Skip 05 1 2 3 Print Print 4 Skip Skip 5 Print 6 Skip Skip 7 [JOB#917] MRS = 0000 #917-A : 1. Printing of Taxable 1 subtotal on X/Z report 2. Printing of Gross Tax 1 and refund Tax 1 total on X/Z report 3. Printing of NetTax 1 total on XR report 1. Taxable 1 subtotal on X/Z report Print Skip 2. Gross Tax 1 and 3. Net Tax 1 total refund Tax 1 total on X/Z on X/Z report 917-A report Print Print Skip 05 1 Print 2 Skip Skip 3 Print Print 4 Skip 5 Print 6 Skip Skip 7 #917-B : 1. Printing of Taxable 2 subtotal on X/Z report 2. Printing of Gross Tax 2 and refund Tax 2 total on X/Z report 3. Printing of Net Tax 2 total on X/Z report 1. Taxable 2 2. Gross Tax 2 and 3. Net Tax 2 subtotal on refund Tax 2 total total on X/Z X/Z report on X/Z report report 917-B Print Print Skip Print Skip Print Skip 0 5 1 2 3 Print Print 4 Skip Skip 5 Skip Print 6 Skip 7 #917-C : 1. Printing of Taxable 3 subtotal on X/Z report 2. Printing of Gross Tax 3 and refund Tax 3 total on X/Z report 3. Printing of Net Tax 3 total on X/Z report 1. Taxable 3 2. Gross Tax 3 and 3. Net Tax 3 subtotal on refund Tax 3 total total on X/Z X/Z report on X/Z report report 917-D Print Print Skip Print Skip Print Skip 0 5 1 2 3 Print Print 4 Skip Skip 5 Print 6 Skip Skip 7 #917-D : 1. Printing of Total Tax amount on X/Z report 2. Printing of Gross manual Tax and refund manual Tax on X/Z 3. Printing of Net manual Tax total on X/Z report 1. Total Tax Amount 2. Gross manual Tax and Refund manual Tax on X/Z report 3. Net manual Tax total on X/Z report 917-D Print Print Skip Print Skip Print Skip 0 5 1 2 3 Skip Print Skip Print 4 Skip 5 Print 6 Skip 7 [JOB#918] MRS = 2000 #918-A : 1. Dirrect non-tendering finalization after previous tender entry 1. Dirrect non-tendering finalization after previous tender entry Disable Enable 918-A 0 2 5 #918-B, C, D : Not used (Fixed at "000")