Casio FC-200V User Guide - Page 61

Conversion Mode

|

UPC - 079767167004

View all Casio FC-200V manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 61 highlights

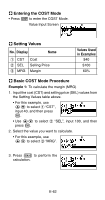

A Calculation Formulas a: Interest portion of payment PM1 (INT) INTPM1 = I BALPM1-1 × i I × (PMT sign) b: Principal portion of payment PM1 (PRN) PRNPM1 = PMT + BALPM1-1 × i c: Principal balance upon completion of payment PM2 (BAL) BALPM2 = BALPM2-1 + PRNPM2 d: Total principal paid from payment PM1 to payment PM2 (ΣPRN) ΣPM2 PRN = PRNPM1 + PRNPM1+1 + ... + PRNPM2 PM1 e: Total interest paid from payment PM1 to payment PM2 (ΣINT) • a + b = one repayment (PMT) ΣPM2 INT = INTPM1 + INTPM1+1 + ... + INTPM2 PM1 BAL0 = PV Payment: End (Setup Screen) INT1 = 0, PRN1 = PMT ... Payment: Begin (Setup Screen) Converting between the Nominal Interest Rate and Effective Interest Rate The nominal interest rate (I % value input by user) is converted to an effective interest rate (I %´) for installment loans where the number of annual payments is different from the number of annual compoundings calculation periods. { }[C / Y ] I%' = (1+ I% )[P / Y ]-1 ×100 100 × [C / Y ] The following calculation is performed after conversion from the nominal interest rate to the effective interest rate, and the result is used for all subsequent calculations. i = I%'÷100 k Conversion Mode • The Conversion (CNVR) Mode lets you convert between the nominal interest rate (APR) and effective interest rate (EFF). E-59