Casio FC-200V User Guide - Page 74

Date Input setting under Configuring Settings - yield to maturity

|

UPC - 079767167004

View all Casio FC-200V manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 74 highlights

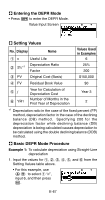

No. Display Name Values Used in Examples 4n Number of Coupon Payments Until Maturity 3 5 RDV*4 Redemption Price per $100 of face value $100 6 CPN*5 Coupon Rate 3% 7 PRC*6 Price per $100 of face value -97.61645734 8 YLD Annual Yield 4% *1 • You can specify a date (Date) or a number of coupon payments (Term) as the term for bond calculations. See the "Bond Date" setting under "Configuring Settings" (page E-16). • You can specify once a year (Annual) or once every six months (Semi-Annual) as the number of coupon payments per year. See the "Periods/Y" setting under "Configuring Settings" (page E-16). *2 • You must input two digits for the month and day. This means you should include a leading zero for values from 1 through 9 (01, 02, 03... etc.) • You can specify either month, day, year (MDY) or day, month, year (DMY) as the date input format. See the "Date Input" setting under "Configuring Settings" (page E-16). *3 When calculating the yield on call, input the call date for d2. *4 When calculating the yield of maturity, input 100 for RDV. *5 In the case of a zero coupon, input 0 for CPN. *6 • When calculating the redemption price per $100 of face value (PRC), you can also calculate accrued interest (INT) and purchase price including accrued interest (CST). • Input money paid out as a negative value, using the y key to input the minus sign. E-72