Casio FC-200V User Guide - Page 69

Entering the DEPR Mode, Setting Values, Basic DEPR Mode Procedure - fc 200 v

|

UPC - 079767167004

View all Casio FC-200V manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 69 highlights

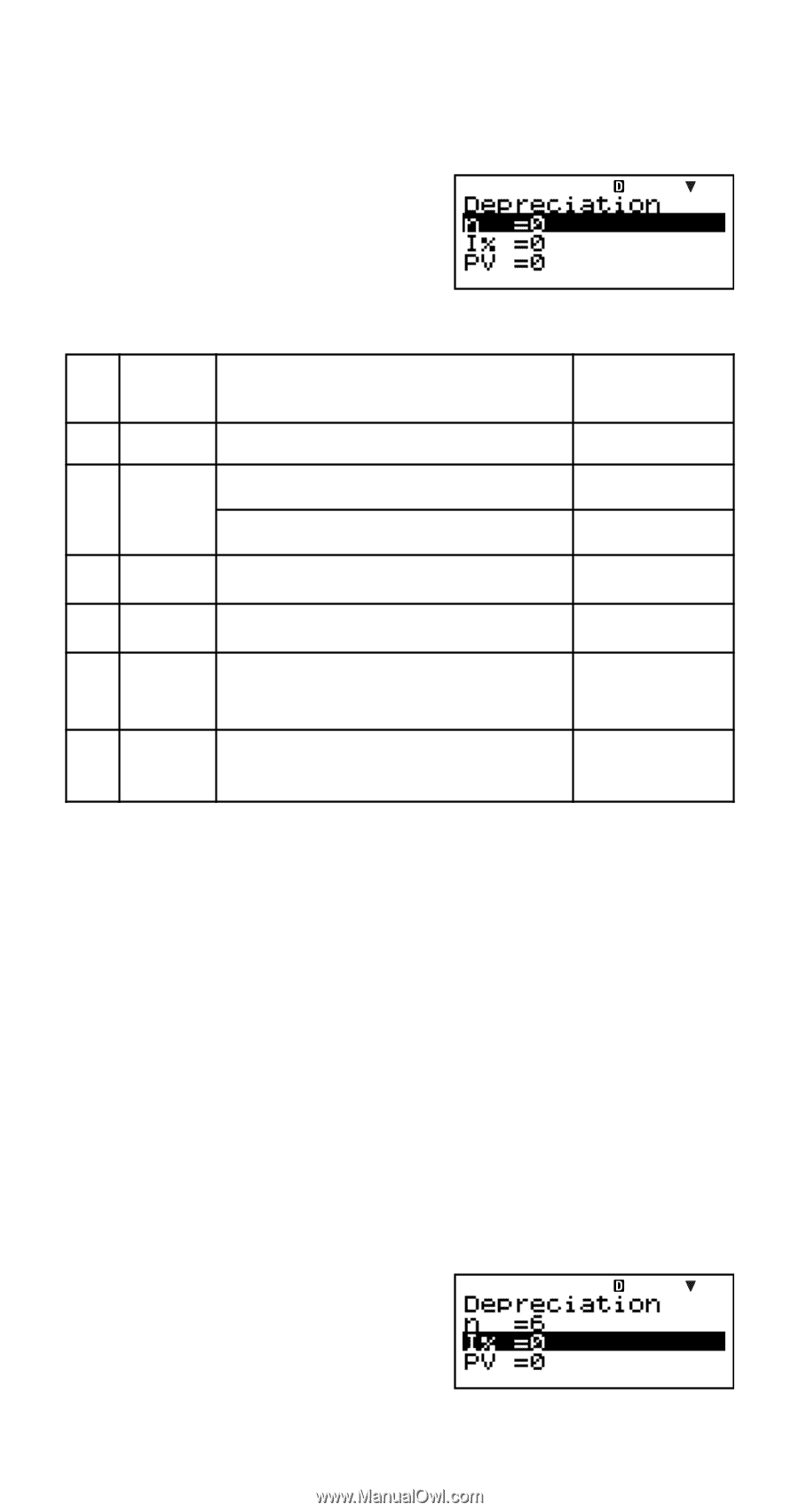

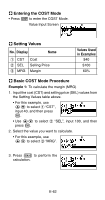

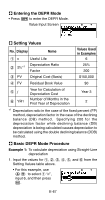

A Entering the DEPR Mode • Press d to enter the DEPR Mode. Value Input Screen A Setting Values No. Display Name 1n 2 I*1 3 PV 4 FV Useful Life Depreciation Ratio Factor Original Cost (Basis) Residual Book Value Values Used in Examples 6 25% 200 $150,000 $0 5j 6 YR1 Year for Calculation of Depreciation Cost Number of Months in the First Year of Depreciation Year 3 2 *1 Depreciation ratio in the case of the fixed percent (FP) method, depreciation factor in the case of the declining balance (DB) method. Specifying 200 for the depreciation factor while declining balance (DB) depreciation is being calculated causes depreciation to be calculated using the double declining balance (DDB) method. A Basic DEPR Mode Procedure Example 1: To calculate depreciation using Straight-Line depreciation 1. Input the values for 1, 2, 3, 4, 5, and 6 from the Setting Values table above. • For this example, use fc to select 1 "n", input 6, and then press E. E-67