Casio TE-3000S User's Manual - Page 38

Preparing and using discounts

|

View all Casio TE-3000S manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 38 highlights

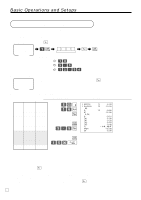

Basic Operations and Setups Preparing and using discounts This section describes how to prepare and register discounts. Programming discounts To program a rate to the p key PGM Mode switch 6 1s 6 : : : : 6 p 6 s Example: Preset rate 10% 2 10 5.5% 2 5^5 12.34% 2 12^34 Registering discounts REG The following example shows how you can use the p key in various types of registration. Mode switch Discount for items and subtotals OPERATION RECEIPT Dept. 1 $5.00 --------- Item 1 Quantity 1 --------- Taxable (1 pr-eset - -P-LU-1-6 -($-10-.00-)pr-eset Item 2 Quantity 1 --------- -----T-axa-bl-e --(2-)pr-eset- -Di-sco-un-t --Ra-te--(-5%-)p-rese-t Subtotal discount Rate 3.5 Taxable Nontaxable Payment Cash $15.00 5-! 16+ p Applies the preset discount rate to the last item registered. s 3^5p The input value takes priority of the preset value. s 15-F 1 DEPT01 1 PLU0016 5% %ST 3.5% %TA1 TX1 TA2 TX2 TL CASH CG T1 •5.00 T2 •10.00 T2 -0.50 •14.50 -0.51 •5.00 •0.20 •9.50 •0.48 •14.67 •15.00 •0.33 • You can manually input rates up to 4 digits long (0.01% to 99.99%). Taxable status of the p key • Whenever you perform a discount operation on the last item registered, the tax calculation for discount amount is performed in accordance with the tax status programmed for that item. • Whenever you perform a discount operation on a subtotal amount, the tax calculation for the subtotal amount is performed in accordance with the tax status programmed for the p key. E 38