Sharp XEA102 Instruction Manual - Page 15

VAT Tax Calculation, Discounts and Premiums Using the Percent Key - programming manual

|

UPC - 074000049093

View all Sharp XEA102 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 15 highlights

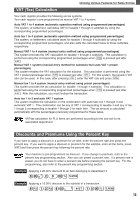

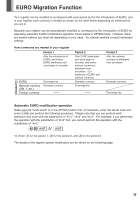

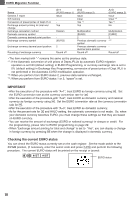

Utilizing Various Features for Sales Entries VAT (Tax) Calculation Your cash register provides the following six tax systems. Your cash register is pre-programmed as manual VAT 1 to 4 system. Auto VAT 1 to 4 system (automatic operation method using programmed percentages) This system, at settlement, calculates VAT for taxable 1 through 4 subtotals by using the corresponding programmed percentages. Auto tax 1 to 4 system (automatic operation method using programmed percentages) This system, at settlement, calculates taxes for taxable 1 through 4 subtotals by using the corresponding programmed percentages, and also adds the calculated taxes to those subtotals, respectively. Manual VAT 1 to 4 system (manual entry method using programmed percentages) This system provides the VAT calculation for taxable 1 through 4 subtotals. This calculation is performed using the corresponding programmed percentages when V is pressed just after S. Manual VAT 1 system (manual entry method for subtotals that uses VAT 1 preset percentages) This system enables the VAT calculation for the subtotal. This calculation is performed using the VAT 1 preset percentage when V is pressed just after S. For this system, the keyed-in VAT rate can be used. In this case, after pressing S, enter the VAT rate and press V. Manual tax 1 to 4 system (manual entry method using preset percentages) This system provides the tax calculation for taxable 1 through 4 subtotals. This calculation is performed using the corresponding programmed percentages when V is pressed just after S. After this calculation, you must finalize the transaction. Auto tax 1 to 3 and auto VAT 1 system This system enables the calculation on the combination with automatic tax 1 through 3 and automatic VAT 1. The combination can be any of VAT 1 corresponding to taxable 4 and any of tax 1 trough 3 corresponding to taxable 1 through 3 for each item. The tax amount is calculated automatically with the percentages previously programmed for these taxes. VAT/tax calculation for PLU items are performed according to the one set for its associated department. Discounts and Premiums Using the Percent Key If you want to apply a discount or a premium for an item, enter the percent rate and press the percent key. If you want to apply a discount or premium for the subtotal, enter all the items, press S and then press the percent key following the percent rate. Your machine is pre-programmed as discount. If you change to premium, refer to the percent key programming section. Also you can preset a percent rate. If a percent rate is preset, you do not have to enter a percent rate before pressing the percent key. For the programming, also refer to the percent key programming section. Example Applying a 20.00% discount to an item belonging to department 3 8:# 20:% t Example Applying a 15.00% discount to the subtotal of a transaction 8P 12P 8:! S 15:% t 13