Sharp XEA102 Instruction Manual - Page 25

Checking the Programmed Machine Settings - program tax

|

UPC - 074000049093

View all Sharp XEA102 manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 25 highlights

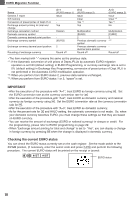

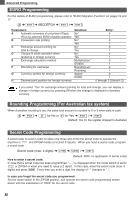

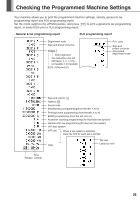

Checking the Programmed Machine Settings Your machine allows you to print the programmed machine settings, namely, general & tax programming report and PLU programming report. Set the mode switch to the Z/PGM position, and press S to print a general & tax programming report, or press P to print a PLU programming report. • General & tax programming report •PLU programming report Department code Sign and preset unit price 000017 Entry digit limit Tax status(from the left, VAT(tax)4, 3, 2, 1; 0 for not taxable; 1 for taxable) SICS (1)/Normal (0) PLU code Sign and preset unit price Associated department code Sign and rate for % Rate for E Secret code Miscellaneous programming(from the left, A to H) Printing format programming (from the left, A to H) EURO programming (from the left, A to H) Australian rounding programming (for Australian tax system) German VAT law programming (for German tax system) VAT (tax) system VAT rate When a tax system is selected, lower tax limit for each tax is printed. Date Tax rate Lower tax limit Time Receipt number 23