Texas Instruments BA II PLUS PRO User Manual - Page 29

Entering Cash Inflows and Outflows, Generating an Amortization Schedule - calculator manual

|

UPC - 033317192045

View all Texas Instruments BA II PLUS PRO manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 29 highlights

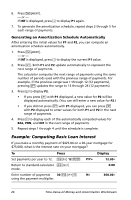

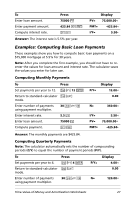

• In worksheet modes the calculator displays only the value you enter or recall, although any variable label previously displayed remains displayed. Note: You can tell that the displayed value is not assigned to the displayed variable, because the = indicator is not displayed. To compute a TVM value, press % and a TVM key in standard-calculator mode. Using [xP/Y] to Calculate a Value for N 1. Key in the number of years, and then press & Z to multiply by the stored P/Y value. The total number of payments appears. 2. To assign the displayed value to N for a TVM calculation, press ,. Entering Cash Inflows and Outflows The calculator treats cash received (inflows) as a positive value and cash invested (outflows) as a negative value. • You must enter cash inflows as positive values and cash outflows as negative values. • The calculator displays computed inflows as positive values and computed outflows as negative values. Generating an Amortization Schedule The Amortization worksheet uses TVM values to compute an amortization schedule either manually or automatically. Generating an Amortization Schedule Manually 1. Press & \. The current P1 value appears. 2. To specify the first in a range of payments, key in a value for P1 and press !. 3. Press #. The current P2 value appears. 4. To specify the last payment in the range, key in a value for P2 and press !. 5. Press # to display each of the automatically computed values: • BAL- the remaining balance after payment P2 • PRN- the principal • INT- the interest paid over the specified range Time-Value-of-Money and Amortization Worksheets 25