Texas Instruments BA II PLUS PRO User Manual - Page 50

Example: Solving for Unequal Cash Flows, Cash Flow Number, Cash Flow Estimate - irr calculation

|

UPC - 033317192045

View all Texas Instruments BA II PLUS PRO manuals

Add to My Manuals

Save this manual to your list of manuals |

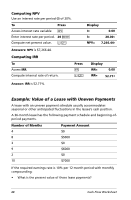

Page 50 highlights

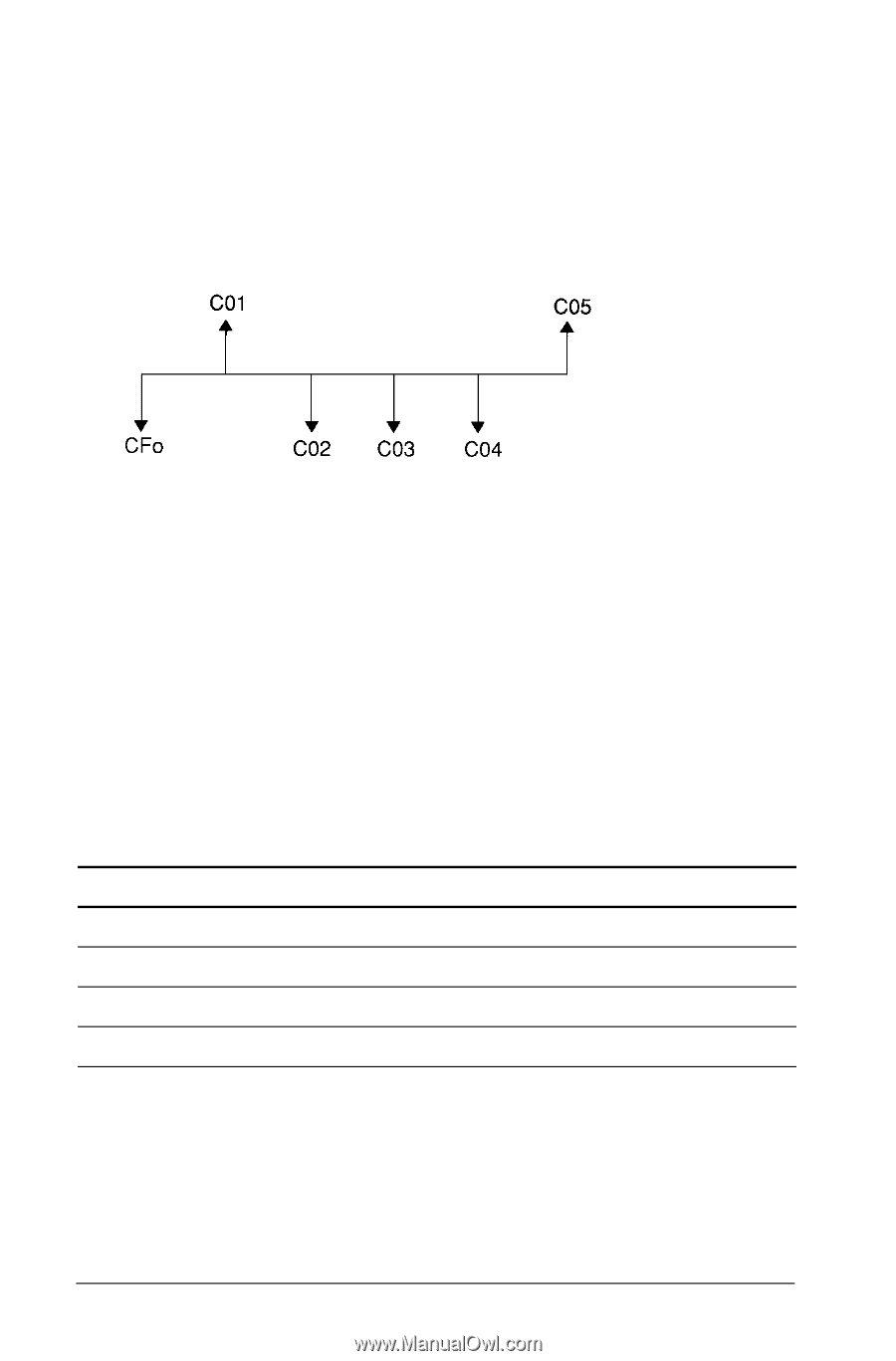

When more than one solution exists, the calculator displays the one closest to zero. Because the displayed solution has no financial meaning, you should use caution in making investment decisions based on an IRR computed for a cash-flow stream with more than one sign change. The time line reflects a sequence of cash flows with three sign changes, indicating that one, two, or three IRR solutions can exist. • When solving complex cash-flow problems, the calculator might not find IRR, even if a solution exists. In this case, the calculator displays Error 7 (iteration limit exceeded). Example: Solving for Unequal Cash Flows These examples show you how to enter and edit unequal cash-flow data to calculate: • Net present value (NPV) • Internal rate of return (IRR) A company pays $7,000 for a new machine, plans a 20% annual return on the investment, and expects these annual cash flows over the next six years: Year Cash Flow Number Purchase CFo 1 C01 Cash Flow Estimate -$7,000 3,000 2-5 C02 5,000 each year 6 C03 4,000 As the time line shows, the cash flows are a combination of equal and unequal values. As an outflow, the initial cash flow (CFo) appears as a negative value. 46 Cash Flow Worksheet