Texas Instruments BA II PLUS PRO User Manual - Page 30

Example: Computing Basic Loan Interest, Generating an Amortization Schedule Automatically - mortgage calculation

|

UPC - 033317192045

View all Texas Instruments BA II PLUS PRO manuals

Add to My Manuals

Save this manual to your list of manuals |

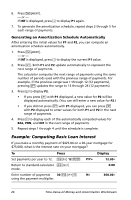

Page 30 highlights

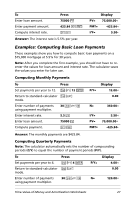

6. Press & \. - or - If INT is displayed, press # to display P1 again. 7. To generate the amortization schedule, repeat steps 2 through 5 for each range of payments. Generating an Amortization Schedule Automatically After entering the initial values for P1 and P2, you can compute an amortization schedule automatically. 1. Press & \. - or - If INT is displayed, press # to display the current P1 value. 2. Press %. Both P1 and P2 update automatically to represent the next range of payments. The calculator computes the next range of payments using the same number of periods used with the previous range of payments. For example, if the previous range was 1 through 12 (12 payments), pressing % updates the range to 13 through 24 (12 payments). 3. Press # to display P2. • If you press % with P1 displayed, a new value for P2 will be displayed automatically. (You can still enter a new value for P2.) • If you did not press % with P1 displayed, you can press % with P2 displayed to enter values for both P1 and P2 in the next range of payments. 4. Press # to display each of the automatically computed values for BAL, PRN, and INT in the next range of payments. 5. Repeat steps 1 through 4 until the schedule is complete. Example: Computing Basic Loan Interest If you make a monthly payment of $425.84 on a 30-year mortgage for $75,000, what is the interest rate on your mortgage? To Press Set payments per year to 12. & [ 12 ! Return to standard-calculator & U mode. Enter number of payments 30 & Z , using the payment multiplier. P/Y= Display 12.00 0.00 N= 360.00 26 Time-Value-of-Money and Amortization Worksheets