HP 20b HP 20b Calculator Quick Start Guide - Page 70

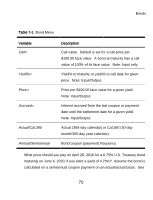

Yield, Price, Accrued, Actual/Cal.360, Annual/Semiannual

|

UPC - 883585875344

View all HP 20b manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 70 highlights

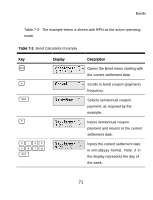

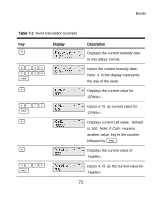

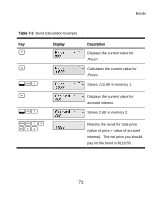

Bonds Table 7-1 Bond Menu Variable Call= Yield%= Price= Accrued= Actual/Cal.360 Annual/Semiannual Description Call value. Default is set for a call price per $100.00 face value. A bond at maturity has a call value of 100% of its face value. Note: Input only. Yield% to maturity or yield% to call date for given price. Note: Input/Output. Price per $100.00 face value for a given yield. Note: Input/Output. Interest accrued from the last coupon or payment date until the settlement date for a given yield. Note: Input/Output. Actual (365-day calendar) or Cal.360 (30-day month/360-day year calendar). Bond coupon (payment) frequency. What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4, 2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment on an actual/actual basis. See 70