HP 20b HP 20b Calculator Quick Start Guide - Page 75

In RPN, press 4

|

UPC - 883585875344

View all HP 20b manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 75 highlights

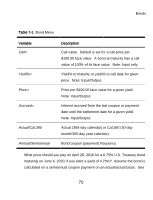

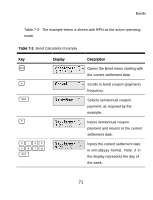

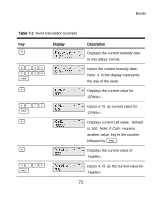

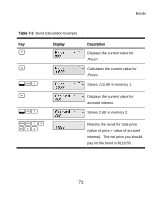

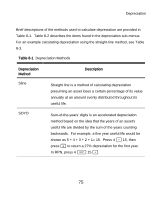

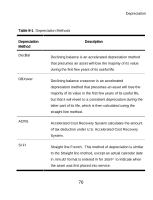

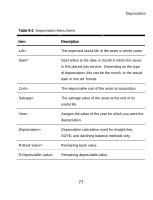

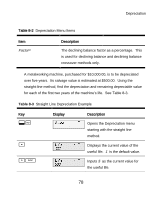

Depreciation Brief descriptions of the methods used to calculate depreciation are provided in Table 8-1. Table 8-2 describes the items found in the depreciation sub-menus. For an example calculating depreciation using the straight-line method, see Table 8-3. Table 8-1 Depreciation Methods Depreciation Method Sline SOYD Description Straight line is a method of calculating depreciation presuming an asset loses a certain percentage of its value annually at an amount evenly distributed throughout its useful life. Sum-of-the-years' digits is an accelerated depreciation method based on the idea that the years of an asset's useful life are divided by the sum of the years counting backwards. For example, a five year useful life would be shown as 5 + 4 + 3 + 2 + 1= 15. Press 4 / 15, then press = to return a 27% depreciation for the first year. In RPN, press 4 I 15 /. 75