HP F2219AA#ABA HP 20b Business Consultant Financial Calculator Manual - Page 43

Cash Flows, NPV and IRR Menu Items, NPV and IRR Example, Table 4-3

|

UPC - 088358587534

View all HP F2219AA#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

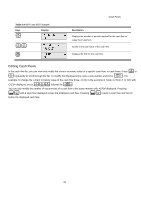

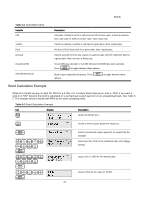

Page 43 highlights

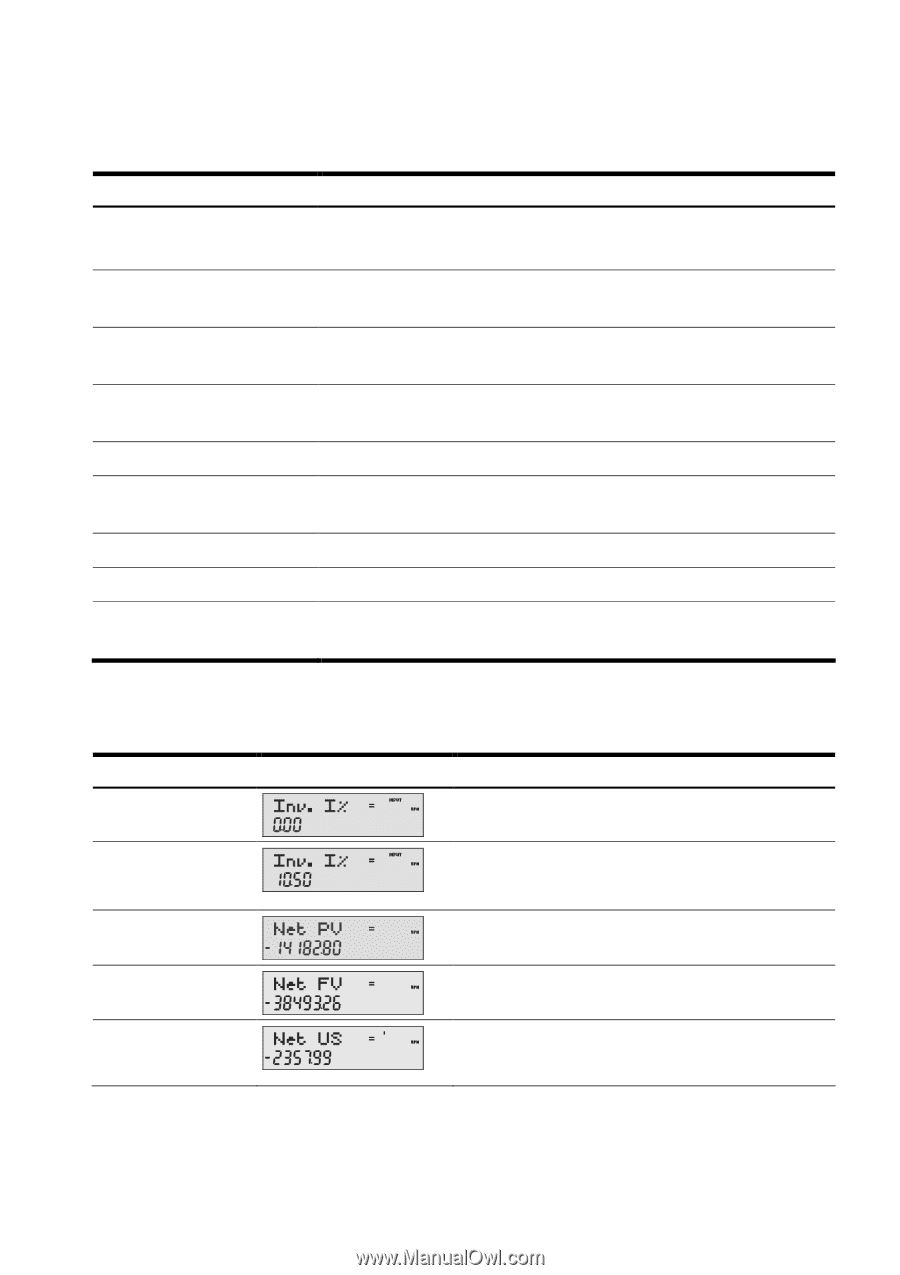

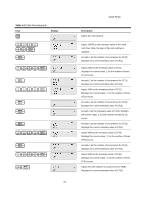

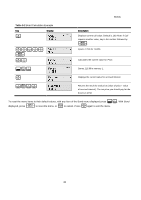

Cash Flows Table 4-3 NPV and IRR Menu Items Item Description Inv. I% Investment or discount rate. Enter the investment rate or discount rate for the cash I flow followed by . Net PV Net present value. Shows the value of the cash flows at the time of the initial cash flow, discounting the future cash flows by the value set for Inv. I%. Net FV Net future value. Shows the value of the cash flows at the time of the last cash flow, discounting the earlier cash flows by the value set for Inv. I%. Net US Net uniform series. Shows the per-period payment of a regular, periodic cash flow of equivalent present value to the cash flow list. Payback Payback. Shows the number of periods for the investment to return value. Discounted Payback Discounted Payback. Shows the number of periods required for the investment to return value if the cash flows are discounted using the value set in Inv. I%. Total The sum of all the cash flows, equivalent to NPV if Inv. I% is 0. #CF/Yr The number of cash flows per year. The default is 1. IRR% Internal rate of return. This is the discount rate for the cash flow that returns a Net Present Value of 0. See Table 4-4 for an example of the NPV and IRR functions using the cash flow example in Table 4-2. Table 4-4 NPV and IRR Example Keys Display Description P Opens the NPV menu. 10. 5I < Inputs 10.5 for investment rate. Displays the NPV of the cash flow with the given Inv. I%. < < Displays the NFV of the cash flow with the given Inv. I%. Displays the Net US of the cash flow with the given interest rate. 43