HP F2219AA#ABA HP 20b Business Consultant Financial Calculator Manual - Page 47

Bond Calculation Example, Table 5-1

|

UPC - 088358587534

View all HP F2219AA#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

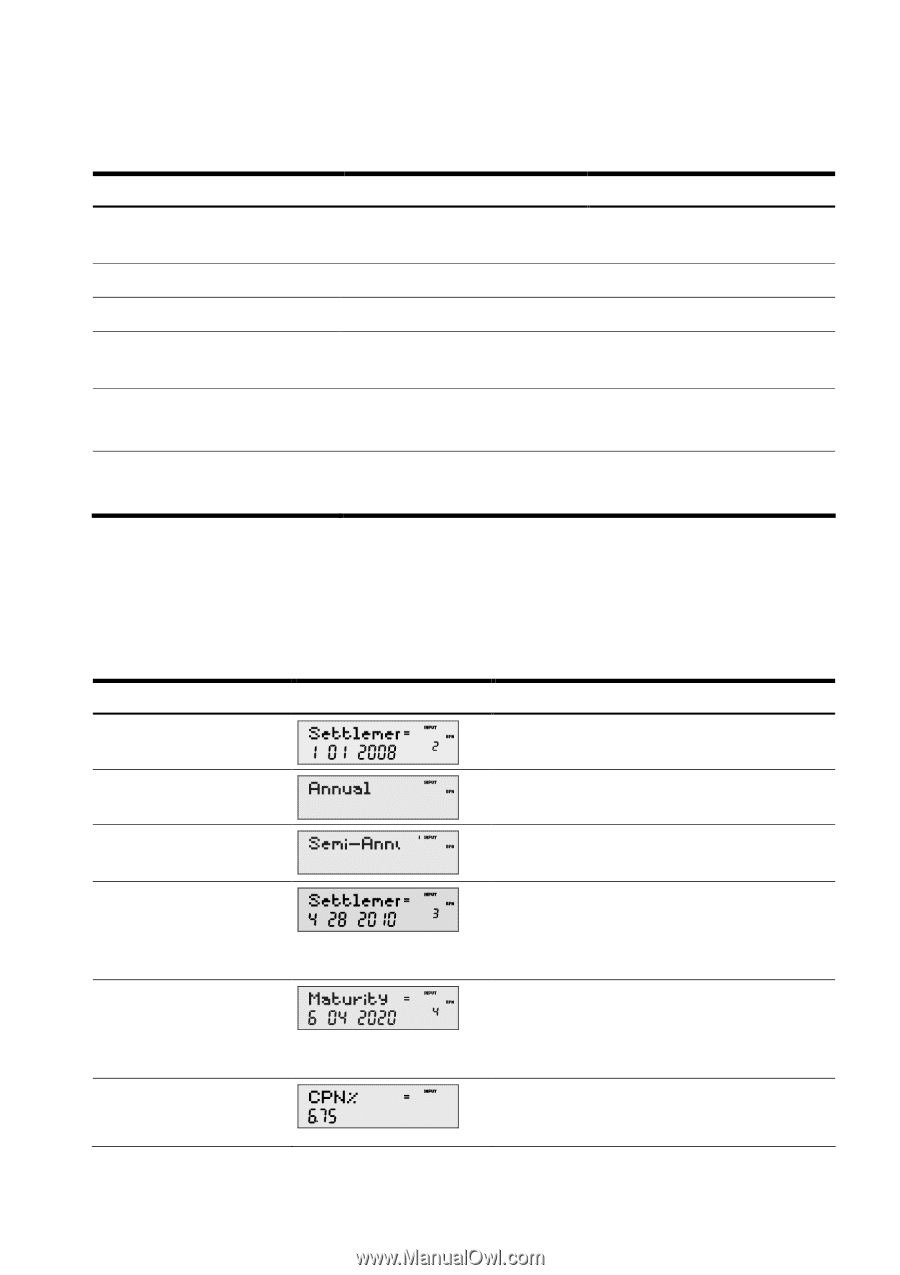

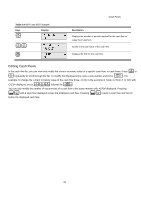

Page 47 highlights

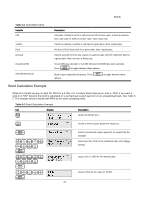

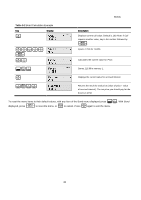

Bonds Table 5-1 Bond Menu Items Variable Call Yield% Price Accrued Actual/Cal.360 Annual/Semiannual Description Call value. Default is set for a call price per 100.00 face value. A bond at maturity has a call value of 100% of its face value. Note: input only. Yield% to maturity or yield% to call date for given price. Note: input/output. Price per 100.00 face value for a given yield. Note: input/output. Interest accrued from the last coupon or payment date until the settlement date for a given yield. Note: this item is Read-only. Actual (365-day calendar) or Cal.360 (30-day month/360-day year calendar). I Press to toggle between these options. I Bond coupon (payment) frequency. Press to toggle between these options. Bond Calculation Example What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4, 2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment on an actual/actual basis. See Table 52. The example below is shown with RPN as the active operating mode. Table 5-2 Bond Calculation Example Key B Display Description Opens the Bond menu. > Scrolls to bond coupon (payment) frequency. I