HP F2219AA#ABA HP 20b Business Consultant Financial Calculator Manual - Page 57

Table 9-1, Depreciation Menu Items

|

UPC - 088358587534

View all HP F2219AA#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 57 highlights

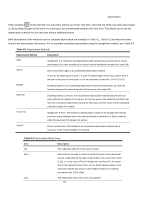

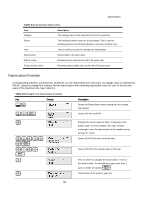

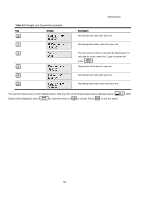

Depreciation < Note: pressing on the last item of a sub-menu returns you to the Year item, not to the top of the sub-menu (see Figure 1). By scrolling through all the items of a sub-menu, you incrementally advance the Year item. This allows you to see the depreciation schedule for the next year without additional entries. Brief descriptions of the methods used to calculate depreciation are provided in Table 9-1. Table 9-2 describes the items found in the depreciation sub-menus. For an example calculating depreciation using the straight-line method, see Table 9-3. Table 9-1 Depreciation Methods Depreciation Method Description Sline Straight line is a method of calculating depreciation presuming an asset loses a certain percentage of its value annually at an amount evenly distributed throughout its useful life. SOYD Sum-of-the-years' digits is an accelerated depreciation method. In SOYD, the depreciation in year Y is (Life-Y+1)/SOY/100% of the asset, where SOY is the sum-of-the-years for the asset, or, for an asset with a 5-year life, 5+4+3+2+1=15. DecBal Declining balance is an accelerated depreciation method that presumes an asset will lose the majority of its value during the first few years of its useful life. DBXover Declining balance crossover is an accelerated depreciation method that presumes an asset will lose the majority of its value in the first few years of its useful life, but that it will revert to a consistent depreciation during the latter part of its life, which is then calculated using the straight line method. French SL Straight line French. This method of depreciation is similar to the Straight line method, except an actual calendar date in the selected format is entered in for Start to indicate when the asset was first placed into service. Amort F French amortization. This method is an accelerated depreciation method with a crossover to the French Straight Line method. Table 9-2 Depreciation Menu Items Item Description Life The expected useful life of the asset in years. Start Start refers to the date or month in which the asset is first placed into service. Depending on the type of depreciation, this can be the month (1-12), or, in the case of French Straight-line and Amort F, the actual date in the selected format. Note: for non-French depreciations, if the asset were placed into service in the middle of March, for example, you would enter 3.5 for Start. Cost The depreciable cost of the asset at acquisition. 57