HP F2219AA#ABA HP 20b Business Consultant Financial Calculator Manual - Page 58

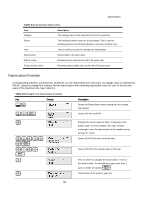

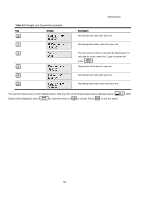

Depreciation Example, Table 9-2

|

UPC - 088358587534

View all HP F2219AA#ABA manuals

Add to My Manuals

Save this manual to your list of manuals |

Page 58 highlights

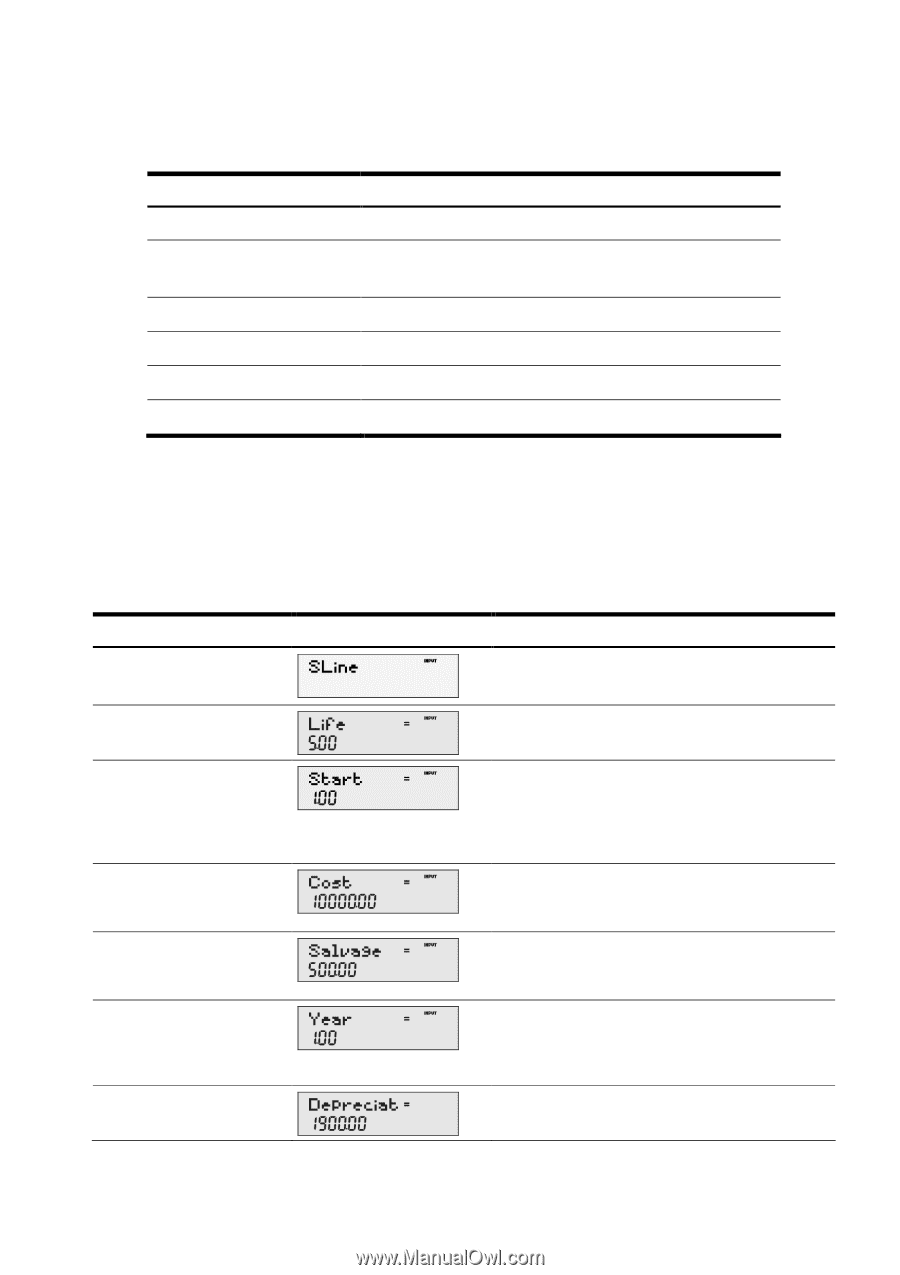

Depreciation Table 9-2 Depreciation Menu Items Item Description Salvage The salvage value of the asset at the end of its useful life. Factor The declining balance factor as a percentage. This is used for declining balance and declining balance crossover methods only. Year Year for which you want to calculate the depreciation. Depreciation Depreciation in the given year. R.Book Value Remaining book value at the end of the given year. R.Depreciable Value Remaining depreciable value at the end of the given year. Depreciation Example A metalworking machine, purchased for 10,000.00, is to be depreciated over five years. Its salvage value is estimated at 500.00. Using the straight-line method, find the depreciation and remaining depreciable value for each of the first two years of the machine's life. See Table 9-3. Table 9-3 Straight Line Depreciation Example Key :\ Display Description Opens the Depreciation menu starting with the straight line method.